Japan Salary Guide 2025: How Much Goes to Tax, Pension & Insurance?

Table of contents

- Gross salary vs. net salary in Japan

- Income tax (所得税 / Shotokuzei)

- Resident tax (住民税 / Jūminzei)

- Pension (年金 / Nenkin)

- Health insurance (健康保険 / Kenkō Hoken)

- Employment insurance (雇用保険 / Koyō Hoken)

- Typical monthly deduction example

- What you can do with your remaining income

- Learn more about managing money in Japan

Understanding your monthly salary in Japan can be confusing, especially if you are new to working here. Many foreigners are surprised when they see their first paycheck and notice that the amount received is lower than the amount written in their contract.

This happens because salaries in Japan are usually shown as gross salary, meaning taxes and social insurance are deducted before you receive your net salary (take-home pay).

Here is a simple guide to help you understand where your money goes and what to expect when working in Japan in 2025.

Gross salary vs. net salary in Japan

- Gross salary – your full salary before deductions

- Net salary – the amount you actually receive after taxes, pension, and insurance.

Most deductions are mandatory and apply to both Japanese and foreign workers.

Income tax (所得税 / Shotokuzei)

Japan uses a progressive income tax system, which means the tax rate increases as income increases.

- Income tax is withheld monthly from your salary

- For many entry-level or mid-range workers, the tax rate starts at around 5%

- The exact amount depends on your income, family situation, and deductions

Photo credit: Nippon

Your employer calculates this and deducts it automatically from your paycheck.

Resident tax (住民税 / Jūminzei)

Resident tax is different from income tax and often surprises new workers.

- It is based on your income from the previous year

- Paid starting June of the following year

- The rate varies by city but is usually around 10%

Photo credit: Backpackingman

For example, if you started working in Japan this year, you may not pay resident tax right away, but it will start the following year.

Pension (年金 / Nenkin)

Japan’s public pension system is mandatory for all workers.

- Total contribution is about 18% of your salary

- Split evenly between employee and employer

- Your portion is deducted monthly

Foreign workers who leave Japan permanently may be eligible to apply for a lump-sum pension withdrawal, depending on how long they contributed.

Health insurance (健康保険 / Kenkō Hoken)

Health insurance is also required for workers in Japan.

- Typically around 10% of salary, split between employee and employer

- Covers 70% of medical costs, including hospital visits and prescriptions

Photo credit: Expatica

This system helps keep medical expenses affordable compared with many other countries.

Employment insurance (雇用保険 / Koyō Hoken)

Employment insurance supports workers if they lose their job.

- Usually around 0.6% of salary

- Covers unemployment benefits and some training programs

Photo credit: Japan Intercultural

This deduction is relatively small but important for job security.

Typical monthly deduction example

Let’s look at a simple example:

Gross salary: ¥250,000 per month

Typical deductions may include:

- Income tax

- Pension

- Health insurance

- Employment insurance

Estimated take-home pay: ¥200,000–¥215,000 per month

The final amount depends on your city, insurance type and family status.

What you can do with your remaining income

Once you understand your net salary, budgeting becomes easier. Many people use their remaining income to:

- Build an emergency fund

- Save for travel or yearly expenses

- Send money home regularly as part of a monthly plan

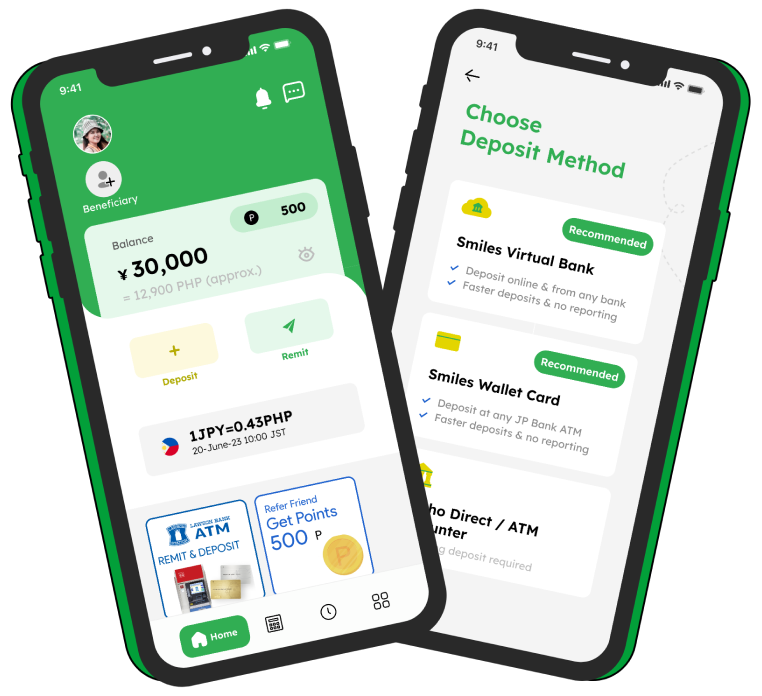

Using a reliable digital service like Smiles Mobile Remittance can help you manage remittances more easily by offering clear exchange rates, low fees and support in your native language.

Learn more about managing money in Japan

Understanding salary deductions is just one part of living in Japan. If you also want help with utilities and payments, read our guide on how to understand Japanese bills to avoid confusion and extra fees.

Knowing where your salary goes helps you plan better, save smarter and make the most of your life in Japan.