Lump-Sum Withdrawal Guide for Japan’s Pension System

Table of contents

If you’re a foreign resident in Japan who’s planning to return to your home country for good, you may be eligible to claim a Lump-sum Withdrawal Payment from Japan’s Kokumin Nenkin (国民年金) or national pension and Kosei Nenkin (厚生年金) or employees’ pension insurance system. This one-time payment lets you receive back part of the pension contributions you made during your stay.

Who Can Apply?

To qualify for the payment, you must meet all the following conditions:

- You are not a Japanese national.

- You paid into the National Pension or Employees’ Pension Insurance for 6 months or more.

- You no longer have an address in Japan.

- You have never qualified for any Japanese pension benefits (including disability).

Important: Be sure to apply within two years after leaving Japan.

What You Need

To apply, you must submit a claim form to the Japan Pension Service. You’ll also need the following:

- A copy of your passport

- Proof you no longer live in Japan (like a removed residence record)

- Proof of your bank account details (not at Japan Post Bank)

- Your Basic Pension Number (from your pension book or notification)

You can apply by mail after leaving Japan. If applying before departure, be sure to submit your tenshutsu todoke (転出届) or moving-out notice first.

Things to Consider

- If you have 10 years (120 months) or more in the system (including eligible foreign agreements), you may qualify for a Japanese pension later.

- Once you claim the lump sum, all your past pension enrollment periods in Japan will be erased.

- If your home country has a social security agreement with Japan (like the U.S., Philippines, Germany, etc.), those periods might be counted toward your future pension there.

Taxes and Refunds

If your claim is from the Employees’ Pension, a tax of 20.42% is withheld. You may get a refund by filing a tax return through a tax representative in Japan.

How is the Lump-Sum Withdrawal Payment Amount Calculated?

The Lump-sum Withdrawal Payment amount = Payment rate × Average standard remuneration

Where:

- The average standard remuneration is your average monthly salary.

- The average monthly salary is calculated by dividing the total salary earned during the insured period (including base salary, bonuses, and overtime pay) by the number of months you worked.

- The payment rate as of April 2021 is as follows:

For example:

- Average standard remuneration : ¥300,000

- Insured period : October 2019 ~ October 2022 (36 months)

- Payment rate : 3.3

Formula: 300,000 × 3.3 = ¥990,000

990,000 x 20.42% = 202,158

990,000 – 202,158 = 787,842

Take home pay = ¥787,842

Payment Limits

As of April 2021, the payment is calculated for up to 60 months (5 years). If you were enrolled for longer, the extra months will not increase your payout, and those months will still be lost once the lump sum is claimed.

Before applying, it’s a good idea to talk to the Japan Pension Office or check nenkin.go.jp to see if a future pension might benefit you more than the lump sum.

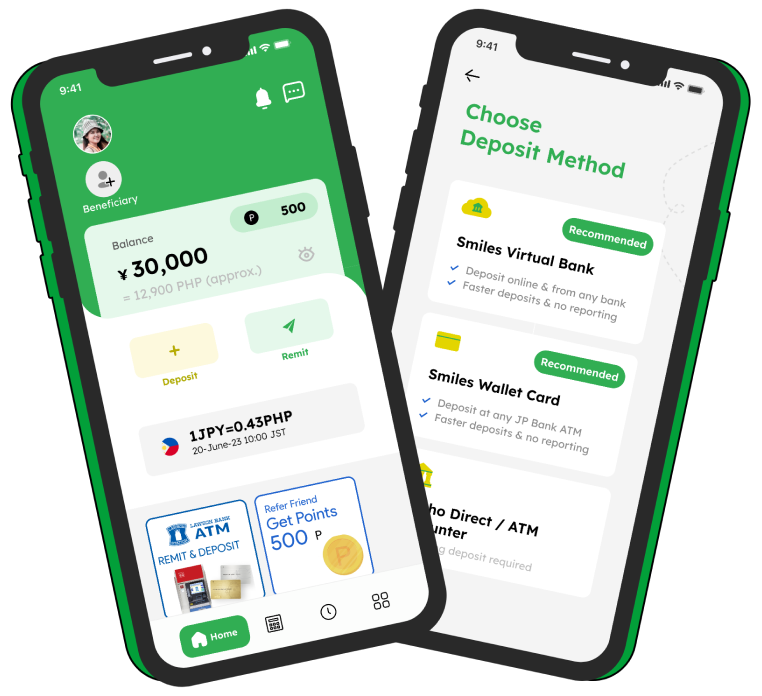

Send money back home with Smiles

If you’re planning to leave Japan soon, you’re probably thinking about how to transfer your savings back home. Smiles Mobile Remittance, Japan’s “absolute number one” mobile remittance app, makes it easy. You can check the JPY to PHP exchange rate and send money anytime, anywhere, directly from your smartphone. Even after you return home, you can still use the app to make transfers and pay bills, as long as your account is funded.