Why Japan Has Remittance Limits and How to Stay Compliant

Table of contents

Many people in Japan send money to family and friends living in other countries. But not everyone knows that there are rules about how much you can send and how often these transfers can happen.

These limits exist because Japan’s financial system is designed to keep money transfers safe and legal. Japanese banks and licensed remittance services must follow rules set by the Financial Services Agency, the country’s financial regulator. The agency works to prevent money laundering, block illegal money flows and protect consumers from fraud.

Understanding these rules can help people avoid rejected transfers and plan large payments more effectively.

How remittance limits work in Japan

When you send money overseas from Japan, the amount you can transfer is often restricted. These remittance limits vary by provider, the transfer method you choose and how much identity verification you have completed.

Here are some common types of limits you may encounter:

- Per-transaction limits – Some services only allow a certain maximum amount of money in a single transfer.

- Monthly caps – There may be a total maximum amount you can send in one month.

- Frequency restrictions – Some services limit how many times you can send money in a day or week.

These rules help financial institutions monitor unusual activity and protect customers from suspicious or risky transfers.

Different methods of sending money such as bank transfers, cash pick-up or mobile wallet transfers, may also have different limits. For example, sending money directly from your bank account often has higher limits than cash pick-ups at physical locations.

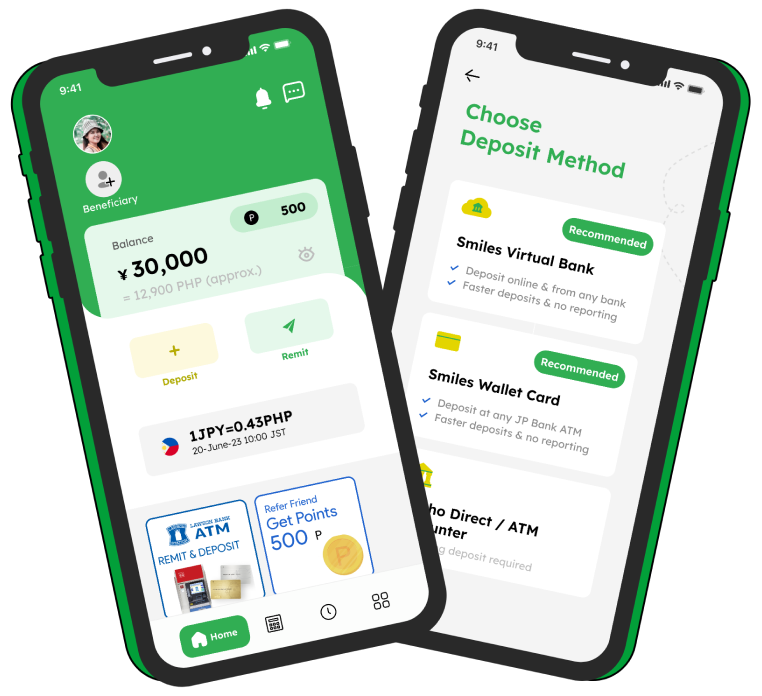

Remittance limits with Smiles

Smiles Mobile Remittance is the absolute no. 1 mobile remittance app in Japan, allowing users to send money overseas quickly and securely. As a licensed remittance provider in Japan, Smiles allows local financial regulations, including limits on how much and how often users can transfer money. These limits depend on factors such as identity verification level, transaction history and the destination country.

You can check the specific remittance limits for Smiles on this page. Knowing your limits ahead of time can help you plan transfers smoothly and avoid delays or rejected transactions.

What to do if you need to send more

If your planned transfer is larger than your current limit allows, there are some steps you can take:

Plan transfers over time

Instead of sending one large amount, you can divide the money into several smaller transfers. This can help you stay within regulatory limits while still moving the funds you need.

Complete additional verification

Many services increase your limits when you provide more identity verification. This may include uploading official ID documents, proof of address or other supporting information.

Understanding documentation requirements

For large transfers, providers may ask for documents that explain the source or purpose of the funds. For example, you may be asked to show employment income statements or invoices for business payments. Being prepared with these documents can prevent delays.

Planning ahead and knowing what documentation may be needed can help your transfer proceed smoothly.

Remittance limits in Japan

Remittance limits are not unique to Japan. Many countries around the world have similar rules to protect their financial system and consumers.

Understanding the rules in Japan allows you to:

- Avoid rejected or delayed transfers

- Plan large payments more effectively

- Send money with confidence

Before making a transfer, always check your provider’s official information on limits and fees. This simple step can help ensure a smooth experience and avoid surprises before your money leaves Japan.