How to Open Bank Account in Singapore for Foreigners

Untagged

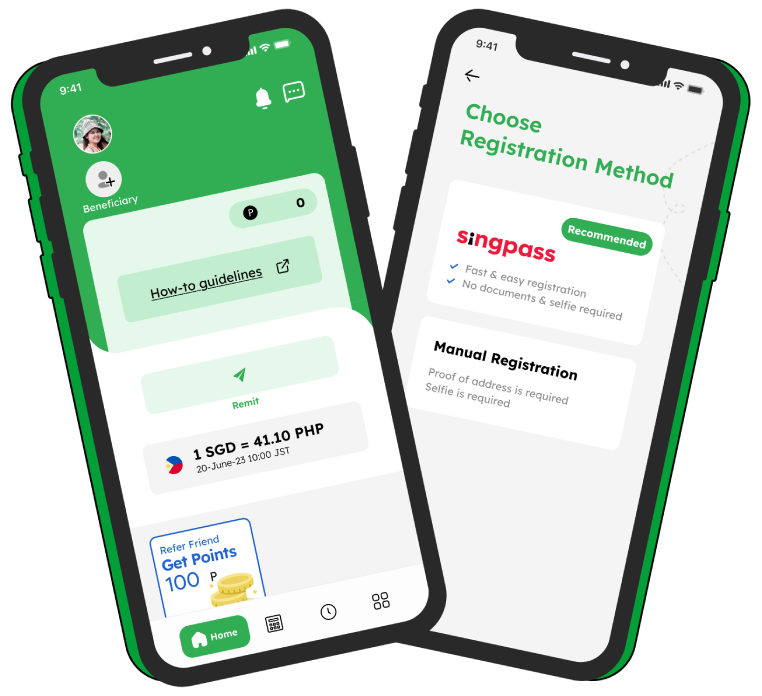

To start off with your new life in Singapore, opening a bank account is one of the first and foremost things you should do. In this blog, Smiles will introduce you to the most basic information about opening a bank account in Singapore as a foreigner. To help you prepare for the process, we will specify what required documents you will need, which bank you should apply for and their addresses. Please read this blog to the end to find answers to commonly asked questions.

How to Open Bank Account in Singapore for Foreigners

Table of contents

1. Which bank should I choose in Singapore?

There are many banks for you to choose from when it comes to opening a bank account in Singapore. The top four biggest banks in Singapore to open an account are POSB, DBS, OCBC, and UOB, as shown in the chart below.

|

Bank acronym |

Bank name |

Website |

Branch locator |

|

POSB |

Post Office Savings Bank |

||

|

DBS |

The Development Bank of Singapore Limited |

||

|

OCBC |

The Oversea-Chinese Banking Corporation Limited |

||

|

UOB |

United Overseas Bank |

2. Can I open a bank account online in Singapore?

Yes, you can open a bank account online in Singapore Most banks in Singapore offer both online and offline applications. To see the required documents and application link, please refer to the following table:

|

Bank |

Online application |

Offline application |

Required documents |

How to/Application link |

|

POSB |

Yes |

Yes |

|

|

|

DBS |

Yes |

Yes |

|

|

|

OCBC |

Yes |

Yes |

|

|

|

UOB |

Only for Singaporeans |

Yes |

|

3. Can foreigners open a bank account in Singapore?

Yes, foreigners are also able to open a bank account in Singapore. Foreigners on a working visa, studying visa or dependent/long-term visit visa can open bank accounts. For more details regarding opening a bank account in Singapore, please refer to the table below:

|

Bank |

Who can apply |

Required documents |

How to/Application link |

|

POSB |

|

|

|

|

DBS |

|

|

|

|

OCBC |

|

|

|

|

UOB |

|

|

4. What documents are required for foreigners to open a bank account in Singapore?

To open a bank account in Singapore, required documents are varied by your residential status. Here, Smiles will list out necessary documents by subject as shown in the following:

- Permanent Resident holders

- NRIC

- Proof of residential address

- Foreigners working in Singapore

- Passport

- Proof of employment

- Proof of residential address

- Foreigners studying in Singapore

- Passport

- Proof of studying in Singapore

- Proof of residential address

- Foreigners (dependent/long-term visit pass)

- Passport

- Dependent/long term visit pass

- Proof of residential address

5. What fees are charged when you open a bank account in Singapore?

Depending on the bank, you may be charged little to no fees when you open an account in Singapore. Please take a look at the following table to see how much you may be charged for each bank.

Smiles hopes that this blog will help relieve the stress you have to go through when you’re opening a bank account in Singapore as a foreigner. We advise that you open a bank account as soon as possible to manage your personal finances with peace of mind and to remit to your home country instantly and economically. If you have any tips to share or have any questions related to this topic, feel free to comment and let us know.