Saving and Investing for OFWs While Working Overseas | Smiles OFW Series

Table of contents

Working overseas is not easy, but for many Overseas Filipino Workers (OFWs), it is a meaningful way to support loved ones and build a better future. Every remittance sent home carries hope, responsibility, and care. That’s why saving and investing for OFWs is just as important as earning more income abroad.

The period of working overseas is often the strongest earning phase in an OFW’s life. How you manage your income during this time can shape your long-term financial security. Starting early with saving and investing for OFWs helps prepare for emergencies, future goals, and a smoother transition when it’s time to return home.

Simple Financial Tips for Saving and Investing for OFWs

1. Track your monthly cash flow

Begin by understanding how much you earn, how much you spend, and how much you send home each month. This simple habit creates awareness and helps prevent unnecessary expenses.

2. Manage debt carefully

If you have high-interest debt such as credit cards or personal loans, prioritize paying them off. Reducing interest payments means more money stays with you.

3. Build a saving habit

A practical guideline is allocating 20% of your income for savings or investments, while the remaining 80% covers living expenses and remittances. As income grows, savings can grow too.

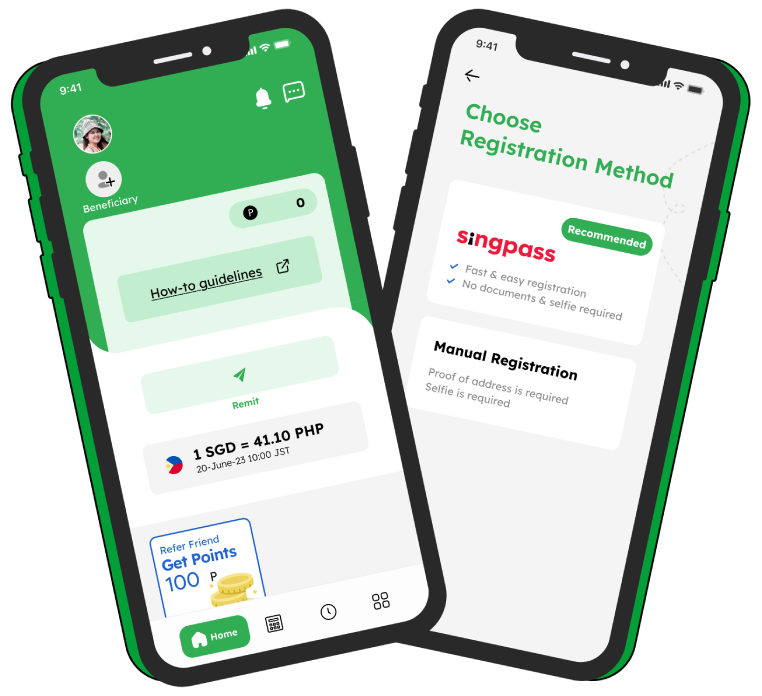

4. Choose cost-efficient remittance services

Using a trusted remittance provider with competitive exchange rates and low fees supports better saving and investing for OFWs in the long run.

5. Protect yourself with insurance

Health and life insurance that covers you while working overseas is essential. It protects both you and your family from unexpected situations.

6. Prepare an emergency fund

Before investing, aim to save at least three months’ worth of your salary. This fund provides financial stability during emergencies.

7. Explore beginner-friendly investments

Once you’re ready, consider affordable options such as ETFs, Unit Trusts, or official programs from institutions like SSS and Pag-IBIG Fund.

8. Invest with understanding

Avoid products or opportunities you don’t fully understand. If it sounds too good to be true, it usually is.

Building Long-Term Security While Overseas

Saving and investing while working overseas is not about pressure. It’s about choices, protection, and peace of mind. By practicing saving and investing for OFWs, you are supporting your family today while also securing your own future tomorrow.

At Smiles, we believe every transaction is part of a bigger journey. one that supports loved ones back home and empowers OFWs to plan with confidence.