Top 5 Quantum computing must invest in 2022

Investment

What are quantum computing and quantum computers?

Read here.

Table of Contents

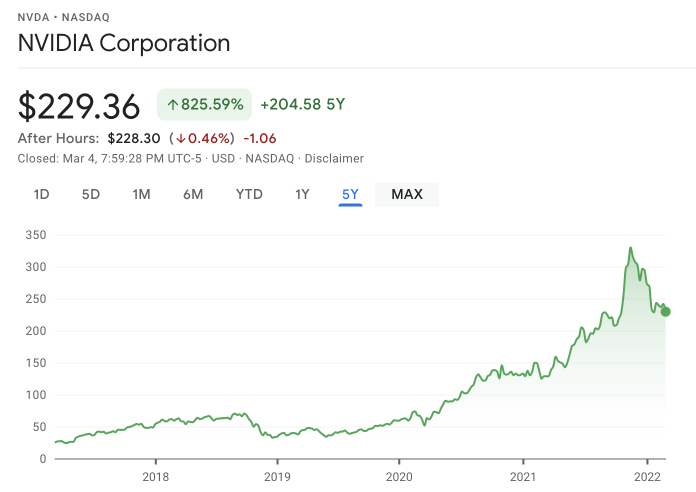

1. Nvidia Corp. (NASDAQ: NVDA)

According to the 2021 financial statement, all of the reported segments witnessed a rise in revenues and gross margin. Also, the net income of FY22 was twice as much as that of FY22, $9.8 billion compared to $4.3 billion.

In addition, regarding the IBD Composite Rating, Nvidia stock’s score now is 93. Generally, stocks with a rating of over 90 are extremely attractive to investors.

Currently, Nvidia has collaborated with various industry leaders, such as IBM, Google Quantum AI, to expedite quantum computing using Nvidia’s cuQuantum software. Furthermore, Nvidia’s data center and gaming businesses are expected to develop rapidly, which leads to a significant opportunity in the virtual world.

Source: Google Finance

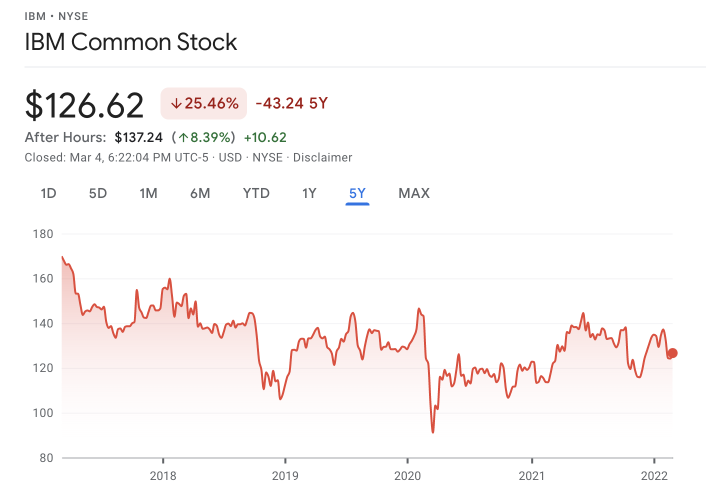

2. International Business Machines Corp. (IBM)

In 2019, IBM unveiled its flagship quantum computer, the Q System One. The Q System One is exclusively available to IBM clients that connect to the company’s quantum processing facility in Poughkeepsie, New York, through the cloud. IBM, on the other hand, is increasing its quantum computing footprint, announcing additional quantum processors in Japan and Germany in mid-2021.

The total revenue of $57.4 billion was up 3.9 percent year over year. It claimed that it had seen its highest quarterly and full-year growth since 2011. In the third quarter, IBM reported a 16 percent increase in hybrid cloud sales to $6.2 billion. Hybrid cloud sales increased by 20% to $20.2 billion for the year. In 2021, IBM acquired 15 firms to improve hybrid cloud and AI technology.

Source: Google Finance

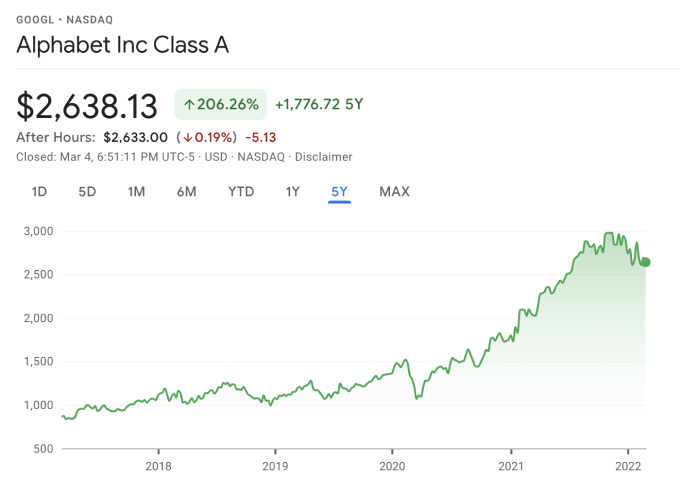

3. Alphabet Inc. (GOOG, GOOGL)

In 2018, Alphabet, the parent company of Google, developed the Bristlecone quantum processor. Alphabet aims to make a commercial quantum computing system accessible by 2029, after opening a new quantum computing research and development lab and data center in 2021. Sandbox, Alphabet’s quantum computing business, is rumored to be on the verge of being spun out, potentially allowing investors to make a pure-play investment in Google quantum computing in the future.

Investors should be aware of the key distinction between the stock ticker symbols GOOG and GOOGL is that GOOG shares have no voting rights, but GOOGL shares do. The stock has gained 62% year-to-date and 276% over the past five years. Revenues have increased at a compound annual rate of 23 percent over the last five years. The company’s margins are likewise solid, with an EBITDA margin of 36 percent and an operating margin of 30 percent during the last year. Both are higher than the company’s projections for 2020, which were 30 percent and 23 percent, respectively.

Source: Google Finance

4. Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC)

Taiwan Semiconductor Manufacturing has collaborated with Taiwan’s Ministry of Science and Technology to develop a cloud computing platform that would help the business remain competitive in the emerging quantum computing sector.

In 2021, Taiwan Semiconductor recorded $57 billion in sales. This was a 19% rise over 2020, resulting in a net income of $21 billion, an increase of 15% over the previous year. Despite the fact that operational expenditures climbed at a slower rate than sales, non-operating income fell by 27% to $470 million last year, reducing profit growth. Analysts also predict that 2022 revenue will reach $75 billion.

TSMC sells for a 36 price-to-earnings (P/E) ratio. It is well below those of its clients, 42 and 83 for AMD, and Nvidia respectively.

*Fact: According to the April report from Boston Consulting and the Semiconductor Industry Association, Taiwan is now the biggest chip maker worldwide, accounting for 92% of the world’s most advanced semiconductor manufacturing capacity. South Korea holds the remaining 8%.

Source: Google Finance

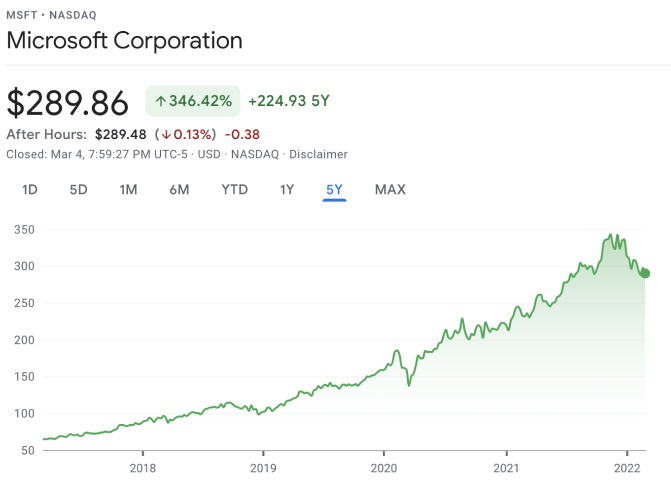

5. Microsoft Corp. (MSFT)

Microsoft’s yearly revenue increased at a compound annual growth rate (CAGR) of only 4.1 percent between fiscal 2011 and fiscal 2016. However, sales increased at a CAGR of 14.5 percent from fiscal 2016 to fiscal 2021. Microsoft’s yearly commercial cloud revenue increased from $12.1 billion (14% of revenue) in fiscal 2016 to $69 billion (41% of revenue) in fiscal 2021.

Microsoft’s earnings were driven by increased sales and expanding margins. Microsoft’s yearly net income fell at a negative CAGR of 6.2 percent from fiscal 2011 and fiscal 2016. However, its yearly net income climbed at a CAGR of 29.5 percent between fiscal 2016 and fiscal 2021. Currently, Microsoft’s diluted earnings per share (EPS) is at 30.11 due to the buybacks.

Source: Google Finance

Disclaimer:

We utilize financial information providers and information from such providers may form the basis for analysis. We accept no responsibility for the accuracy or completeness of any information herein contained. Additionally, any third-party information provided therein does not reflect the views of us or any of their subsidiaries or affiliates. Opinions are the authors; not necessarily that of ours or any of its affiliates, subsidiaries, officers, or directors. All investments involve risk and past performance does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or other financial products.