Top Investment Options for OFWs 2024

OFW

As overseas Filipino workers (OFWs) in Japan or anywhere else in the world, we are aware that our time in a foreign country is limited unless we are able to convert our status to being an immigrant from a foreign country. Many would also choose to retire in the Philippines, particularly because we find it consoling to be close to family members and lifelong friends.

With this in mind, it is vital to realize that investing in your future is essential to ensure that you are able to feed yourself and support your lifestyle in the Philippines, especially if you have already retired.

To guide our hardworking OFWs on how to create a proper investment plan in the Philippines, we have prepared a list of legitimate investment options that you may want to consider.

Regular SSS Program and WISP Plus

The regular Social Security Program is known to many Filipinos as this has been widely advertised to all working adults, both in the Philippines and abroad, due to the several benefits that it provides, which include employment benefits, disability benefits, retirement benefits and more.

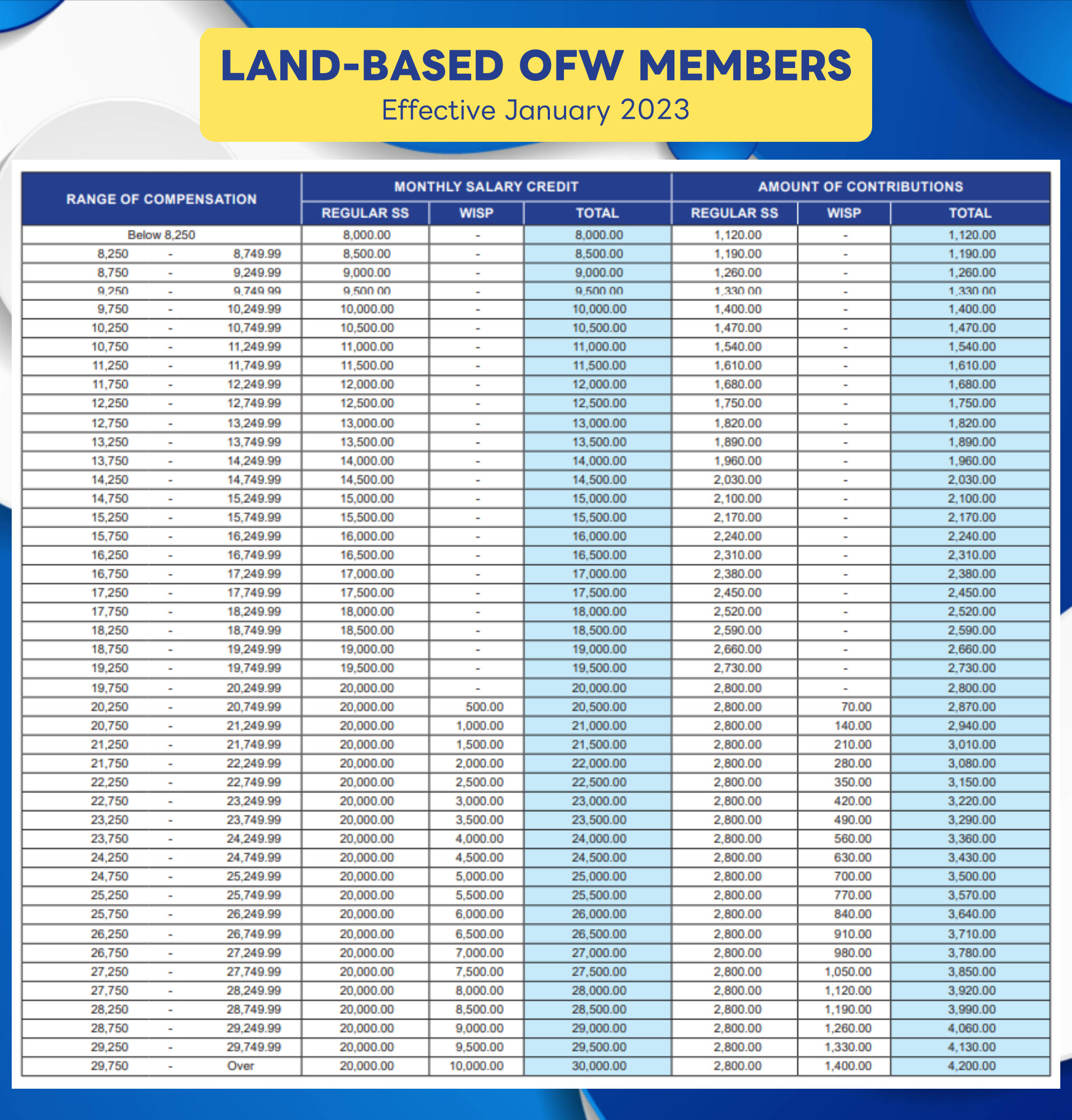

OFWs have the freedom to choose the amount they want to pay monthly. However, they should note that the amount that they will receive in the future will depend on how much they contributed in the past. Therefore, it is recommended that OFWs contribute more if they have more than enough funds in their account.

OFWs may refer to this table if they want to know how much they should contribute to SSS.

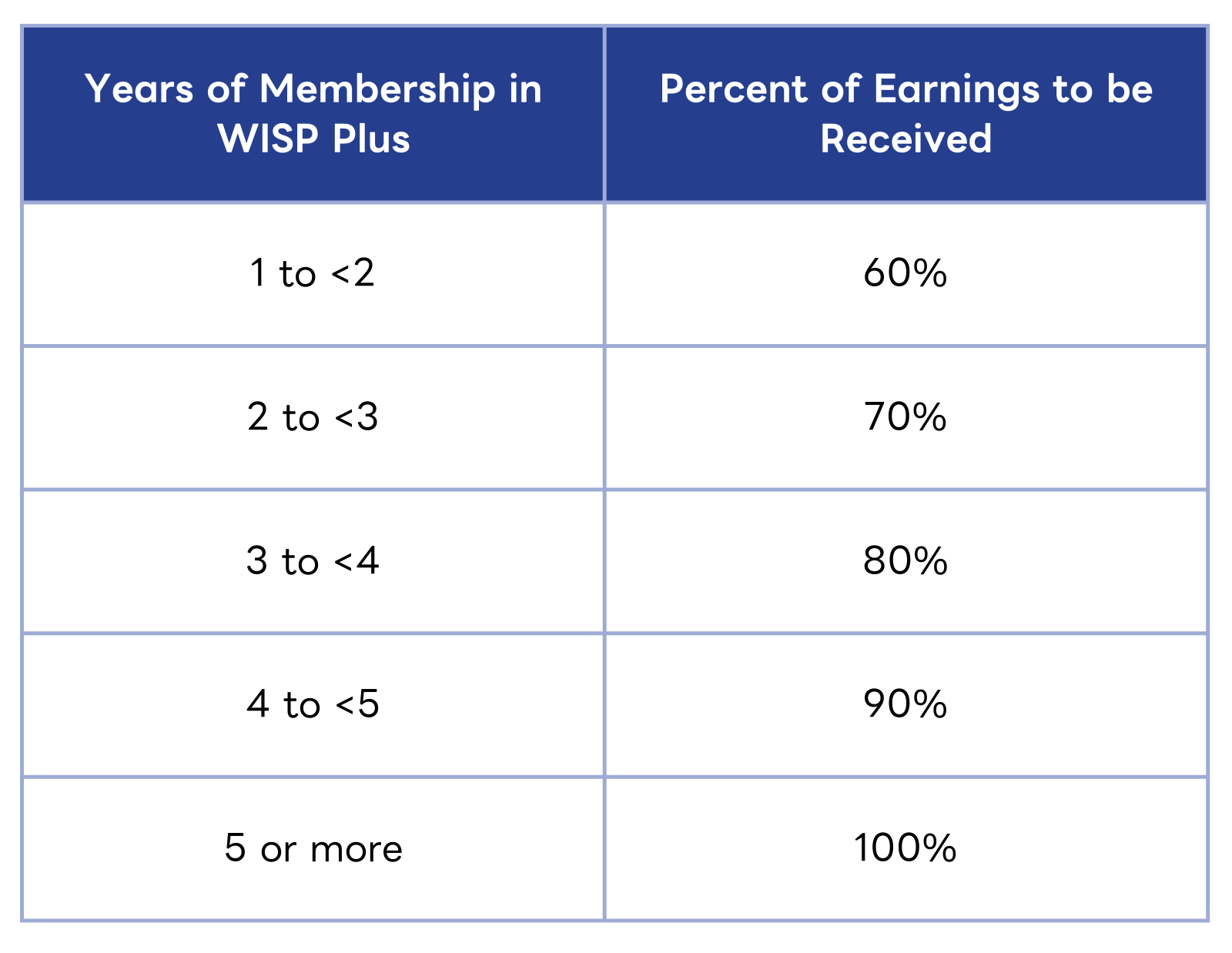

In addition to the regular Social Security Program, in January 2021, SSS introduced its newest retirement savings plan for its active members – Worker’s Investment and Savings Program (WISP) Plus. For as low as 500 PHP, all SSS members, regardless of membership type, can voluntarily enroll in this program.

WISP Plus is beneficial for OFWs as it is affordable, tax-free and provides more benefits, which are added to the ones they can receive from the regular SSS Program.

An SSS member shall receive adjusted earnings based on the following:

Pag-IBIG MP2 Savings

The Modified Pag-IBIG MP2 Savings Program is a special voluntary savings program, designed for active Pag-IBIG members who aim to save more and earn higher dividends. This savings program has a 5-year maturity, and members can re-apply for a new MP2 savings account once they reach the maturity period of their previous account.

The minimum amount required to enroll in this program is 500 PHP per remittance. But a member can have the option to remit a one-time lump sum amount for the whole 5-year period.

OFWs are encouraged to enroll in this program because it is known to provide higher dividends. This means it will give its members a larger amount during payout. This program also ensures the safety of all the money forwarded into their accounts as it is backed by the Philippine government.

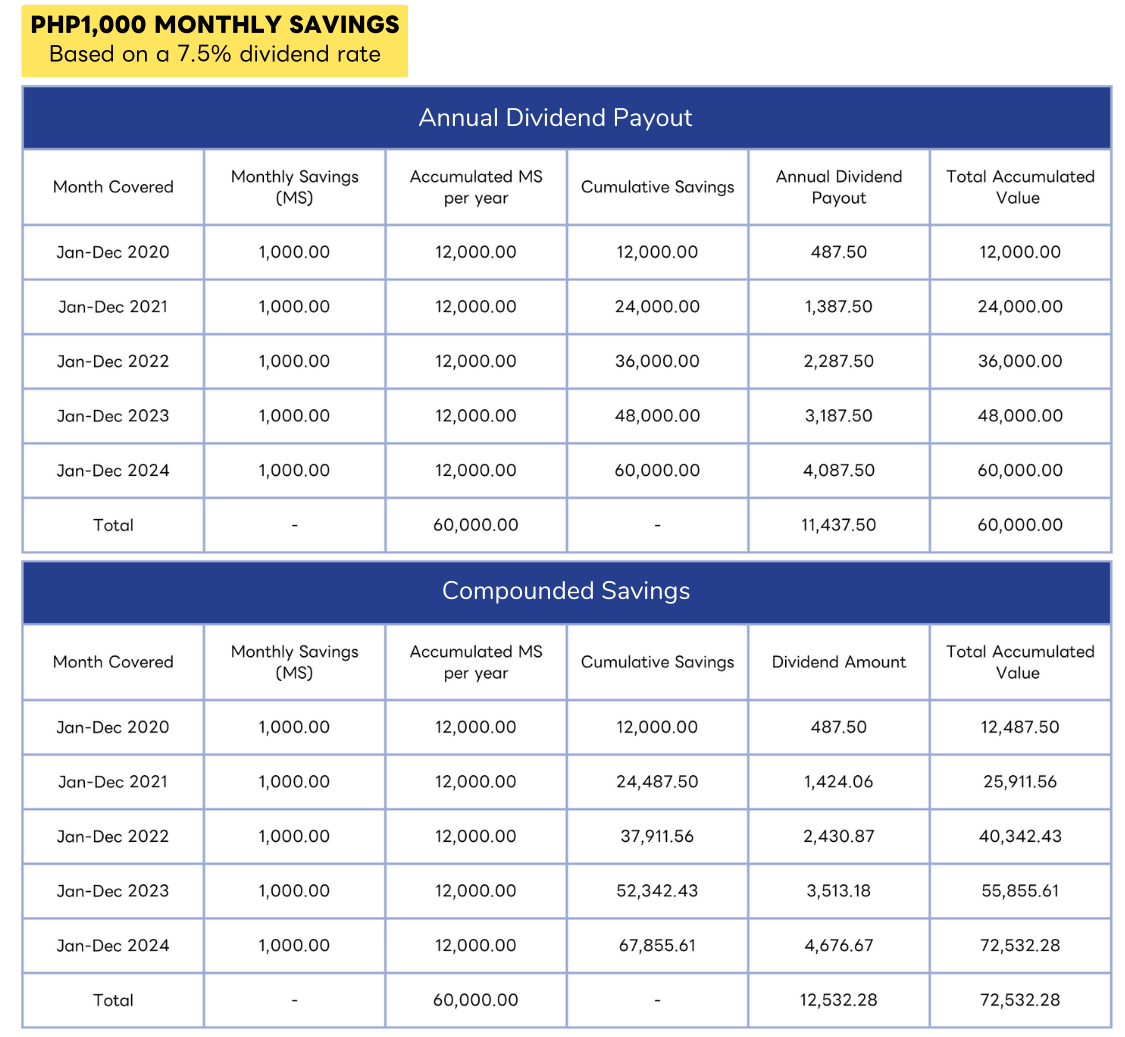

To have a clear understanding of how much a member could earn in five years, please refer to this table:

Unit Investment Trust Fund (UITF)

UITF is another investment option wherein an investor permits a professional fund manager to manage one’s fund. The fund manager may invest these funds in stocks and bonds to make a profit.

Though there are risks associated with this kind of investment because of the volatility of the stock market and the business environment, one is still expected to earn a profit because UITF is a diversified investment, where a fund manager invests in various industries and companies. So even if one market fails, there is a big chance that the other markets will not.

The safety of UITF investments is ensured because, unlike mutual funds, it is being handled by banks and supervised by the Bangko Sentral ng Pilipinas.

If you are considering this investment option, you may contact your most trusted bank in the Philippines and start investing from them. Additionally, you may check the table below for the list of institutions where you may want to invest your money.

Real-estate investment

Now that the Philippines is being recognized as one of the fastest-growing economies in Asia. It is high time for OFWs to invest in real estate while they are still relatively cheap because its demand is expected to increase in the coming years, especially since young professionals are expected to crowd the central cities and more foreign investors are planning to invest in the country.

These real estate investments may include condominiums, agricultural lands, homes and other forms of real estate. Unlike cars and other goods that depreciate in value, it is always expected that land value will increase for obvious reasons, such as the demand for these properties and the infrastructure improvement that affects the value of the nearby properties.

To earn from a real estate investment, an OFW may rent the place out such as an Airbnb, make it a co-living space or build a student dorm. For agricultural land, it may be leased to another individual or group and one may earn from it on a monthly or quarterly basis.

Building your own business

In connection with real estate investment, an OFW may opt to build a business from the property that one possesses. This will be greatly beneficial as it will provide the OFW with a passive income that is being generated consistently.

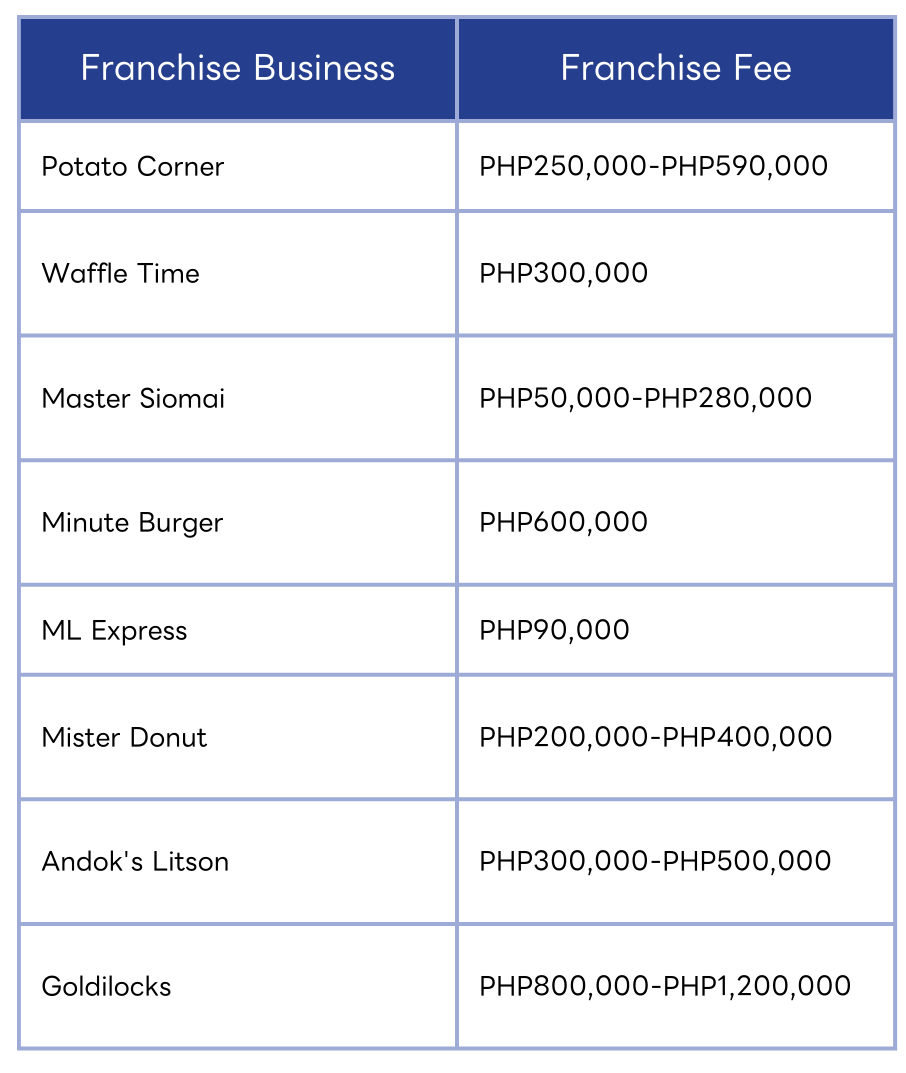

Another form of business is franchising which is already common among many Filipinos. If you are interested in this type of business, you may check the list below to know which type of product you might be interested in venturing into:

Ultimately, every OFW’s dream is to be able to afford to live comfortably the moment one decides to retire from work and return home to the Philippines. This is why it is crucial for everyone to make a proper investment to ensure their future.

An OFW may want to consider investing in government agencies’ savings programs, which include the regular savings program of SSS and the modified savings program of MP2. Another option is earning a passive income through UITF and real estate investments. Lastly, it is also possible for an OFW to build one’s own business if there is enough budget and if one is willing to take risks, especially since there are already many options available.

Have you thought about investing in the future? What investment opportunities have you gotten yourself into? We would like to hear your thoughts and advice.

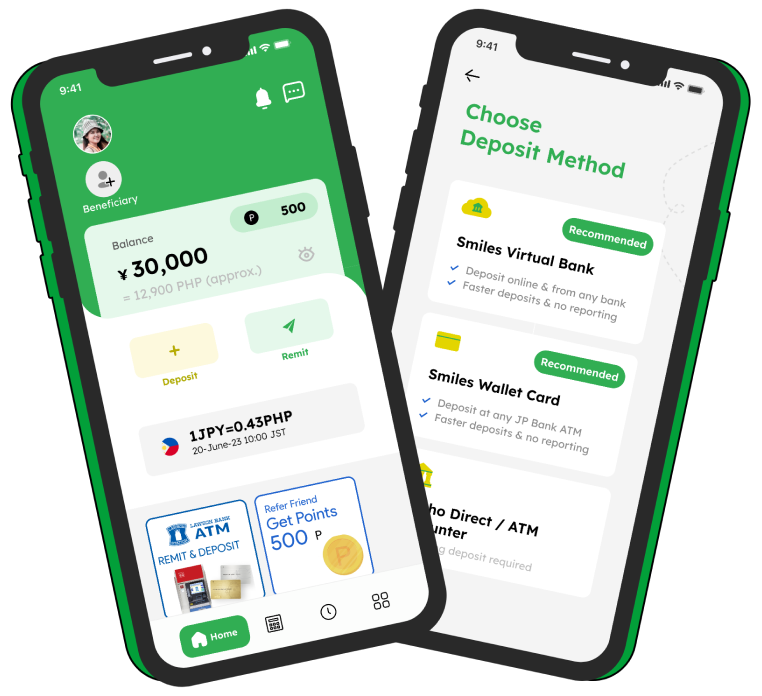

Save more with Smiles Mobile Remittance

While it is always important to think about our future, we must not also forget the present or more specifically our current situation.

As OFWs, we always send money to our loved ones in the Philippines for their daily needs. However, we must not forget that we have our own needs to tend.

Smiles see this concern and hopes to share as many resources and useful information. That’s why we make sure that everyone is able to save enough money, even when they send large amounts to their loved ones. With Smiles Loyalty Points, remittance fees may be lowered or even zeroed out. So, instead of paying high fees, you now have the chance to enjoy what you saved for your own personal needs.

If you’re new here, be sure to download the Smiles App to experience its high-tech and advanced remittance features.