Steps on How to Apply for a Rakuten Credit Card

Instructions

Rakuten is one of the largest companies in Japan that offers a variety of services. They offer internet, mobile data, credit card services, etc. Apart from the infamous Rakuten food delivery service and their online shopping platform, Rakuten Ichiba, Rakuten Credit Card is also a well-known service Rakuten offers its customers in Japan. With easy-to-follow registration procedures, no annual fees for certain types of cards and the additional loyalty points program, the Rakuten Credit Card is widely used not only by the Japanese but also by foreigners living in Japan. In this article, we will introduce you to the Rakuten Credit Card, its benefits and steps to apply for it.

Before we dig in, here’s a heads up before your Rakuten Credit Card application and use:

- Reserve adequate money in your bank account for emergency situations.

- Loan funds with small installments.

- On the 27th of every month, credited cash from the previous month will be deducted from your bank account. In case of default payment from your bank account, interest will be charged on the amount of the default payment.

Benefits of the Rakuten Credit Card

- Rakuten family card: The family card is an extra card that an immediate family member can use. Any added cards will share the credit card limit.

- Expenses are all easily trackable and manageable.

- Numerous discounts and cash-back points are available.

- It’s more convenient to pay your monthly bills.

- Have the ability to build your credit history.

- Withdraw cash at any time.

- Rakuten points can be used for shopping online or investing in Japanese companies’ stocks.

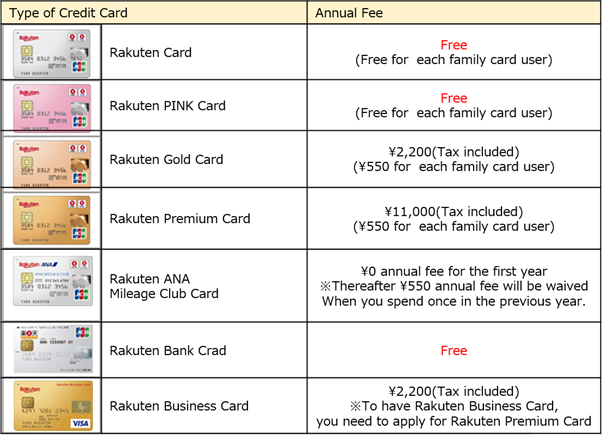

Types of Rakuten Credit Cards and annual fees

Steps to register the Rakuten Credit Card online:

1. Enter the official website in your browser:

https://www.rakuten-card.co.jp/campaign/rakuten_card/

and select the “楽天会員の方” option if you are a Rakuten member, or select the “楽天会員でない方” option if you’re currently not a member.

2. After selecting “楽天会員でない方,” choose the type of card you desire. They offer VISA, Mastercard, JCB and American Express. However, we recommend choosing a VISA or Mastercard as it can be used in almost all countries. Then, choose a design for your Rakuten Credit Card.

3. Enter your name, gender and date of birth. You can use katakana in both the first and second row, while the last row is for the romaji/alphabet characters. The alphabetic characters inputted in the last row will be printed and displayed on your card.

4. Fill in an active Japanese phone number. For the email address portion, you can either input an email address from your mobile carrier or your regular email.

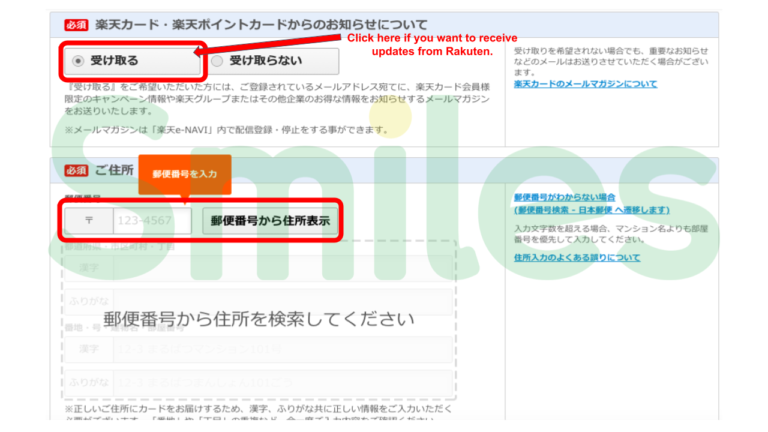

5. Select the “受け取る” option if you want to receive updates from Rakuten (e.g., promotions, news, etc.). Select “受け取らない,” if you’re not interested in receiving any of them. After that, enter the postal code of your address in Japan. You should input your current address data because the card will be sent to that address.

- Input your family information. Select…

- The second option if you live with a spouse and children

- The third one if you’re only living with a partner

- The fourth option if you don’t have a partner nor children

- The fifth one if you’re single and living apart from your family

- The last option if you’re single, but you’re living with your family

Note: You have to specify below how many members are living with you (including yourself).

7. Input the status of your place of residence and how long you have lived in that particular place. Then, choose “支払いあり” if you have loans, or select “支払いなし” if you do not have any. Lastly, select your occupational status (e.g., employee, student, not working, etc.).

8. Select the bill to be sent to your home (自宅). You can choose the purpose of the card (either for shopping(普通のお買い物等に利用)or cash withdrawal(現金のお借り入れ等に利用)).

After that, they will ask whether you borrowed money from other companies or not. Please choose “あり” if you are borrowing or “なし” if you’re not borrowing anything.

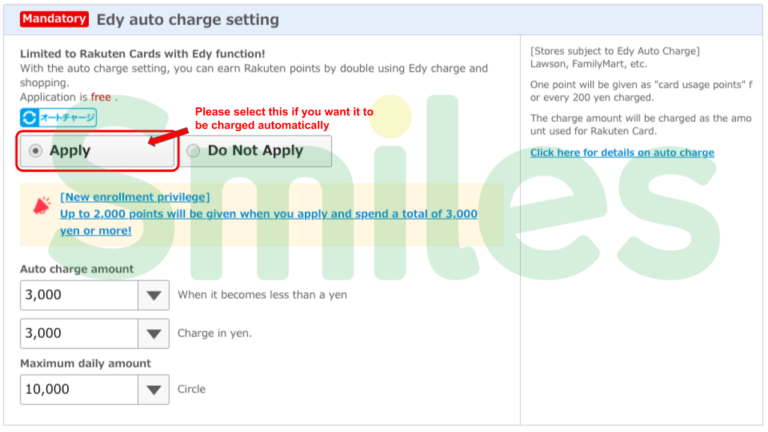

Next, please choose “希望する” to add the Edy feature on the card or select “希望しない” if you’re not interested.

9. A note about the Edy feature:

“Rakuten Edy” is a prepaid form of e-money. You can charge money from your bank account to a Rakuten credit card with the Edy feature. By simply touching your Edy card onto the reader when you check out at a store, you can instantly finish the payment. If you end up choosing Edy, you can choose how much you want it to be charged automatically when you’re shopping at stores that accept payments using Edy.

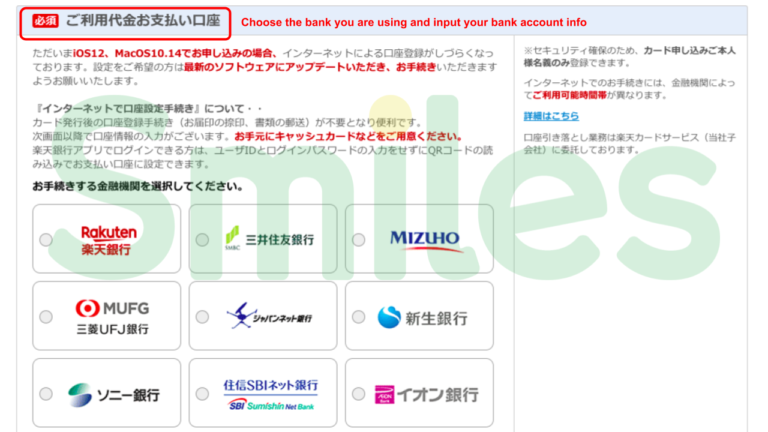

10. Link your bank account to Rakuten Credit Card. Simply choose the bank you are using and input your bank account info. In order to make sure there are no mistakes upon inputting your information, carefully confirm your cash card or bank book details.

As mentioned earlier, on the 27th of every month, the credited cash of the previous month will be deducted from your bank account. In case of default payment from your bank account, interest will be charged on the amount of the default payment.

11. If you find it difficult to register your bank account online, you can also register by snail mail. In case of registering via snail mail, Rakuten will send you the mail with the Rakuten Credit Card and a form in which you are required to declare your bank account information. Receiving the card does not necessarily mean your Rakuten Credit Card is ready to use. Please don’t forget to send the form back to Rakuten to complete your Rakuten Credit Card application.

12. Confirm and agree to the terms and conditions.

Once you are done with the online application, you only need to wait for a confirmation phone call from Rakuten within two to three business days. They will confirm your basic information such as your name, date of birth and home address according to the ID card/residence card you inputted. This call will be in Japanese. If you input your bank information online, it will take about a week after the phone confirmation to receive the Rakuten Credit Card. If you choose to fill out your bank account information via snail mail, don’t forget to send the form back to Rakuten to complete your Rakuten Credit Card application.

The Rakuten Credit Card will be ready to use after you receive it and send back the bank account confirmation form. Again, on the 27th of every month, the credited cash from the previous month will be deducted from your bank account. In case of default payment from your bank account, interest will be charged to the amount of the default payment. We hope that by applying for the Rakuten Credit Card, it will be a game-changer for your daily life.