Things you need to know about Individual Income Tax

Untagged

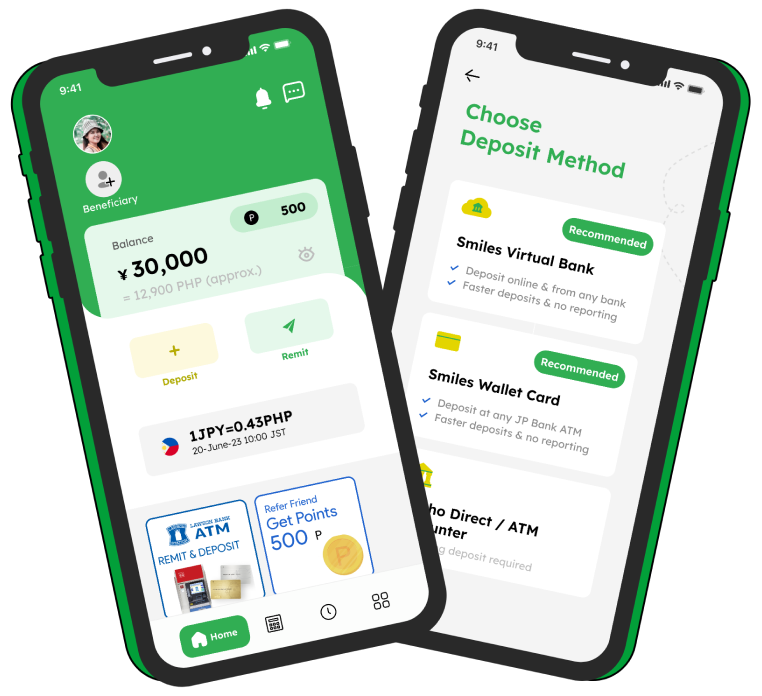

Individual income tax (所得税) is imposed on Non-Japanese citizens. In Japan, besides the resident tax depending on the area you live in, individual income tax makes up a significant amount of your income. Income tax can be up to 43%, if your income is 40 million yen/year or more. Calculating the income tax, based on tax provisions in Japan, is very complicated.

How many times a year do you pay taxes? When? How is tax and tax refund 年末調整 calculated? This article tries to answer all your questions about individual income tax in Japan.

Table of contents

1. What is individual income tax?

Individual income tax is a tax calculated based on your annual income, according to predetermined milestones. The range of taxable income of foreigners working in Japan depends on the type of residency in Japan. There are 2 types of residency:

● Non-resident: A foreigner living in Japan for less than 1 year to the present time.

● Resident: A foreigner with a registered “address” and living in Japan for more than 1 year up to the present time.

Residents are divided into two subgroups, “permanent” and “non-permanent”. Those who have Japanese nationality or who have lived in Japan for more than 5 years (in the last 10 years from the present time) and want to stay for a long time.

2. Types of taxable income

● Permanent residents: Income in Japan, income abroad, and income paid from abroad but received in Japan.

● Permanent residents: domestic income and income paid from abroad but received in Japan.

● Non-residents: domestic income.

An easy way to understand it is: the longer you stay, the higher the personal income tax you have to pay.

3. How to calculate income tax

● Step 1: Total YEAR income – deductions = earned income.

● Step 2: Earned Income – deductions from earned income = taxable income.

● Step 3: Taxable income x tax rate = income tax.

● Step 4: Income tax – deductions from income tax = income tax payable.

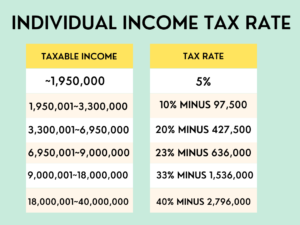

4. Personal income tax rate

1. Aokigahara Forest – The Suicide Forest

Location: Yamanashi Prefecture, Japan

Aokigahara Forest, famously known as the suicide forest. It is located at the foot of one of the most beautiful mountains in the world, Mt. Fuji. Historically, it is said that Aokighara forest was a place where monks would go to starve themselves to death. Others say it was also used to practice ‘ubatse’ or the practice of leaving old women to die in the forest. In modern days, it is known to be the go-to forest for those who want to commit suicide.

5. Example of total taxable income

A person who has lived and worked in Tokyo, Japan since 2018 and ended a labor contract back to the Philippines on December 31, 2020. For more than 1 year and less than 5 years, in this case, the permanent personal income tax bracket applies.

You can find the income information from the monthly payroll, then subtract deductions (such as deductions for dependents) and other deductions to calculate TOTAL taxable INC , and then multiply by each tax bracket specified above.

6. Deductions from income

The Japanese tax authorities have very clear regulations for every case of deducting income taxes. Examples include: contributions to the Government of Japan, special deductions for spouses, deductions for people with disabilities, and most importantly, deductions for dependents.

The deduction for dependents should include the following notes:

Dependents must be over 16 years old. Usually, dependents are registered as spouses or parents.

Dependents must have forgotten blood relatives (named in the household registration book with you) and have an income of less than 103 JPY/year.

If the dependent is over 65 years old, the amount is deductible, not taxable, up to 48K JPY. Usually only 30K JPY/dependant is deducted.

7. How to pay personal income tax in Japan

The amount of income tax will be calculated and deducted from your monthly salary (also known as deduction at the source). In addition, the resident must submit to the employer (the company you are working for) “the declaration of deduction for the family circumstances for people with taxable income from wages (when changing jobs)” until the first payday of the year. Thanks to the tax system at source, most people living and working in Japan do not need to file their own personal income tax returns.

Cases of self-declaration and payment of personal income tax:

● The person leaves Japan before the end of the tax year.

● When the person’s company is working outside of Japan, no income tax is withheld from the employee.

● That person works for more than 1 company.

● If the person’s annual income is over 20,000,000 yen.

● If the person has an external income of more than 200,000 yen

Note: non-residents cannot file “reductions for taxable income from wages (when changing jobs)”.

8. Year-end tax adjustment

Non-residents are not subject to year-end tax adjustments.

In the case of residents, when you receive your last salary of the year, the difference between the total annual income tax paid by the company every month for you, and the actual amount of income tax payable (the annual tax amount ) will be settled. This procedure is called “year-end tax adjustment”.

Usually, the company or union will help you make your personal income tax adjustments at the end of the year. You will receive a Tax Adjustment Form (年末調整) and simply fill in the information.

However, if you do your own tax adjustment, maybe after calculating the actual personal income tax payable, you can do one of the following two ways to receive a Tax Adjustment slip (年末調整).

- Go to the website of the NTA Tax Authority >> Download the tax return and fill in the Tax Adjustment Form (年末調整).

- Go to the Tax Department (税務署 – Zeimusho) or the People’s Committee of the District / City (区役所、市役所 – Kuyakusho, Shiyakusho) where you live to do the procedure. The best time is in February every year. The tax staff is very dedicated and specific, so you need not worry.

You can also update the new tax policies prescribed by the Japanese Government at the website of the Japan Tax Service . Note: the tax refund from year-end personal income tax adjustment only applies to those who have worked and paid taxes.

9. How to adjust year-end tax

The documents the company will distribute to the Employee include:

- 給与所得者の基礎控除申告書(兼)給与所得者の配偶者控除等申告書(兼)所得金額調整控除申告書: Basic deduction declaration for people with salary income / Withholding declaration for spouse, Income adjustment deduction declaration.

- 給与所得者の扶養控除等(異動)申告書: Deduction declaration for the person you support monthly.

- 給与所得者の保険料控除申告書: Insurance premium deduction declaration.

For the Insurance Withholding Statement, usually the intern does not need to fill it out. Or if you are interested, you can find out on the website of the Japanese Tax Service about insurance policies that are regulated by the Government to withhold personal income tax. When coming to Japan, you should have documents such as a household registration book (notarized copy), birth certificate (original) or the above documents to be able to flexibly use when needed.