Bank charges: ATMs or internet banking service in Japan

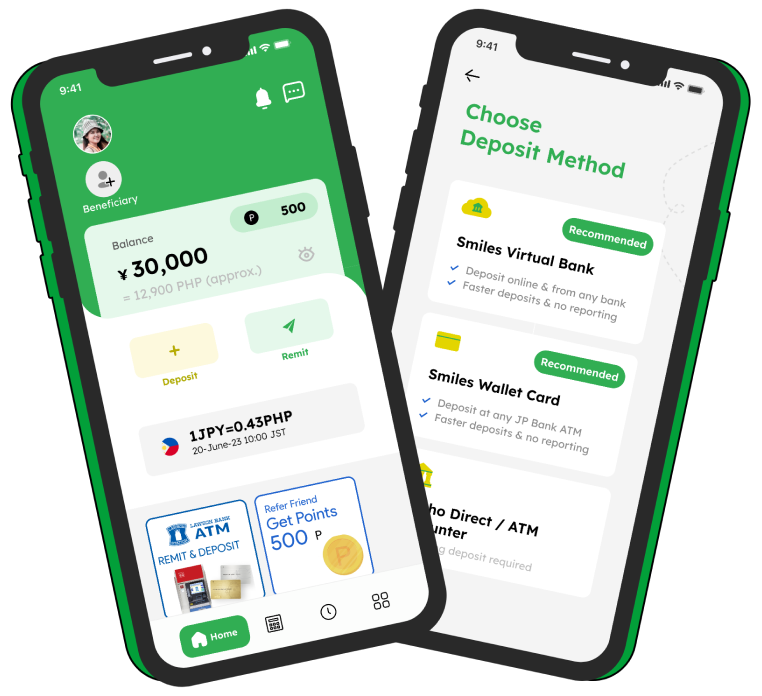

App

Bank charges in Japan may be distinguished to 2 methods: ATMs transfer and internet banking services. Almost all bank charges in Japan are free when you make a money transfer by internet banking service. This article has updated the bank charges of the top 10 domestic banks in Japan such as open bank account fee, ATMs transaction fee or internet banking ranges of charger.

Specially, Japan Post Bank (Yucho), Mizuho, Mitsubishi UFJ Bank, Mitsui Sumitomo and Resona, Seven Bank… Furthermore, several online banks, most notably Yucho Internet Banking, Seven Bank, have recently gained popularity and offer their customers banking via the internet and a network of ATMs.

Bank charge to open account

Bank charge to open an account which is not required by the issuing bank, as well as the maintenance fee. However, some banks require an amount of balance to keep non of charge service. After submitting the document, a bank book and ATM card will be sent to your mail address.

Smiles recommend opening a bank account such as Yucho, Shinsei or Seven Bank. These bank guidelines are supported in English (Shinsei and Seven Bank) or Bahasa Indonesia, Tagalog Philippines and Vietnamese. Their bank tellers have also supported you in English in case you need to go to the bank desk.

Some banks only allow expats who are at least 6 months living in Japan to open their bank account as well as Shinsei bank. You must have ready in hand these documents to open bank account:

- Medium 6 months expiry date passport

- Personnel seal (hanko/inkan)

- Valid Japanese residence card (zairyu)

- My number in case oversea transaction

For your information, some banks may accept driving licenses in lieu of residence cards. Most banks do not require a minimum deposit to open an account and do not charge a fee to maintain it.

:: Click here to know HOW TO OPEN BANK ACCOUNT IN JAPAN

Bank charges of ATM services

To withdraw money free of charge, you must check ATMs time frame, some banks apply free of charge their ATM service from 7AM to 7PM as well as Seven Bank. Japanese ATMs allow their customers to withdraw, deposit and transfer money, as well as update their bank books. While the number of 24 hour ATMs is increasing, most ATMs maintain business hours and are closed for a few hours each night. Expat should note that a considerable number of ATMs cannot be used with foreign issued debit and credit cards.

There are 2 banks that operate many more ATM locations: Japan Post Bank (Yucho) has about 27,200 ATMs, and Seven Bank has more than 22,000 ATMs in the whole country. You can find most of their ATMs in post offices, but some are at train stations and supermarkets or 7-Elevens convenience stores. Aeon Bank has its ATMs in Aeon malls and large shopping areas which operate shy of 20 cities in Japan.

Bank transfer in Japanese (Furikomi)

Bank transfer (furikomi) is very diverse in Japan. You could make the transaction at the bank teller, ATMs or internet banking application that just takes a couple of minutes to progress. Most Japanese prefer to transfer money via internet banking. You may know it is called direct banking services such as Yucho Direct (ゆうちょダイレクト), MUFG Direct (三菱UFJダイレクト), Mizuho Direct (みずほダイレクト). A bank transfer fee is typically free of charge (same bank internet banking transaction) to 600 Yen depends on which type of transaction or when you make a transfer.

You can transfer money from Japan to another country which is called remittance. But you may register the service first and it costs several thousand Yen as a remittance fee.

:: Tips to make a safe bank transfer Furikomi in Japan.

:: Explore the Smiles Remittance Fee which costs below 1% amount money of transaction.

#1. Japan Post Bank – Yucho ゆうちょ銀行

| Bank Charges | ATMs (Card/Book) | ATMs (Cash) | Tellers (Card/Book) | Tellers (Cash) | Internet Banking |

|---|---|---|---|---|---|

| To Yucho bank account | 100 yen | < 5 man : 152 yen ≥ 5 man : 366 yen |

146 yen | < 5 man : 203 yen ≥ 5 man : 417 yen |

FOC 5 times a month From 6th transaction: 100 yen |

| To other domestic bank account | < 5 man : 220 yen ≥ 5 man : 440 yen |

Not support | < 5 man : 660 yen ≥ 5 man : 880 yen |

Not Support | < 5 man : 220 yen ≥ 5 man : 440 yen |

- In case transaction by cash at ATM that bank charges 100 yen for each 10 Man of limit for a transaction. You do not need Yucho account to do this service.

- Smiles recommend using Yucho internet banking to transfer to Yucho account which bank charges no cost.

:: Click to know How to register Yucho Internet Banking.

#2. Mitsubishi UFJ (MUFG)

| Bank Charges | ATMs (Card/Book) | ATMs (Cash Transaction) | Tellers | Internet Banking |

|---|---|---|---|---|

| To MUFG same branch bank account | Free Of Charge | < 3 Man : 220 yen ≥ 3 Man : 440 yen |

< 3 Man : 330 yen ≥ 3 Man : 550 yen |

Free Of Charge |

| To MUFG bank account | 110 yen | < 3 Man : 220 yen ≥ 3 Man : 440 yen |

< 3 Man : 330 yen ≥ 3 Man : 550 yen |

Free Of Charge |

| To other domestic bank | < 3 Man : 275 yen ≥ 3 Man : 440 yen |

< 3 Man : 440 yen ≥ 3 Man : 660 yen |

< 3 Man : 660 yen ≥ 3 Man : 880 yen |

< 3 Man : 220 yen ≥ 3 Man : 330 yen |

- Out of time ATMs service that bank charges additional 100 Yen for each transaction. Office service: 8:45 – 21:00.

- Smiles recommend using MUFG Direct – internet banking to transfer to the same account which bank charges no cost.

- MUFG ATMs are able to make a transaction in cash or other bank ATMs.

#3. Mizuho

| Bank charges | ATMs (Card/Book) | ATMs (Cash) | Teller | Internet Banking |

|---|---|---|---|---|

| To Mizuho bank account | 220 yen | < 3 man : 220 yen ≥ 3 man : 440 yen |

< 3 man : 440 yen ≥ 3 man : 660 yen |

Same branch bank – FOC Other branchs < 3 man : 110 yen ≥ 3 man : 220 yen |

| To other banks | < 3 man : 330 yen ≥ 3 man : 440 yen |

< 3 man : 440 yen ≥ 3 man : 660 yen |

< 3 man : 770 yen ≥ 3 man : 990 yen |

< 3 man : 220 yen ≥ 3 man : 440 yen |

- Out of time ATMs service that bank charges additional 100 ~ 200 Yen for each transaction. Office service: 8:45 -18:00.

- Smiles recommend using Mizuho Direct – internet banking to transfer to the same account.

- MUFG ATMs are able to make a transaction in cash or other bank ATMs, as well as transfer money by Mizuho card at other bank ATMs.

#4. Mitsui Sumitomo (SMBC)

| Bank Charges | ATMs (Card/Book) | ATMs (Cash Transaction) | Tellers | Internet Banking |

|---|---|---|---|---|

| To SMBC same branch bank account | Free Of Charge | < 3 Man : 220 yen ≥ 3 Man : 440 yen |

< 3 Man : 220 yen ≥ 3 Man : 440 yen |

Free Of Charge |

| To MUFG bank account | 110 yen | < 3 Man : 220 yen ≥ 3 Man : 440 yen |

< 3 Man : 330 yen ≥ 3 Man : 550 yen |

Free Of Charge |

| To other domestic bank | < 3 Man : 220 yen ≥ 3 Man : 440 yen |

< 3 Man : 440 yen ≥ 3 Man : 660 yen |

< 3 Man : 660 yen ≥ 3 Man : 880 yen |

< 3 Man : 220 yen ≥ 3 Man : 440 yen |

- Out of time ATMs service that bank charges additional 100 ~ 200 Yen for each transaction. Office service: 8:45 -18:00.

- Smiles recommend using UFJ Direct – internet banking to transfer to the same account.

- SMBC ATMs are able to make a transaction in cash or other bank ATMs, as well as transfer money by UFJ card at other bank ATMs.

#5. Resona

| Bank Charges | ATMs (Card/Book) | ATMs (Cash Transaction) | Tellers | Internet Banking |

|---|---|---|---|---|

| To Resona same branch bank account | Free Of Charge | 330 yen | 500 yen | Free Of Charge |

| To Resona bank account | 110 yen | 330 yen | 550 yen | Free Of Charge |

| To other domestic bank | 440 yen | 660 yen | 880 yen | 220 yen |

- Out of time ATMs service that bank charges additional 100 ~ 200 Yen for each transaction. Office service: 8:45 -18:00.

- Smiles recommend using Resona Group – internet banking to transfer to the same account.

- Resona ATMs are able to make a transaction in cash or other bank ATMs.

#6. Chiba

| Bank Charges | ATMs (Card/Book) | ATMs (Cash Transaction) | Tellers | Internet Banking |

|---|---|---|---|---|

| To Chiba same branch bank account | Free Of Charge | < 3 Man : 220 yen ≥ 3 Man : 440 yen |

< 3 Man : 330 yen ≥ 3 Man : 550 yen |

Free Of Charge |

| To Chiba bank account | < 3 Man : 110 yen ≥ 3 Man : 220 yen |

< 3 Man : 220 yen ≥ 3 Man : 440 yen |

< 3 Man : 330 yen ≥ 3 Man : 550 yen |

Free Of Charge |

| To other domestic bank | < 3 Man : 330 yen ≥ 3 Man : 550 yen |

< 3 Man : 550 yen ≥ 3 Man : 770 yen |

< 3 Man : 660 yen ≥ 3 Man : 880 yen |

< 3 Man : 220 yen ≥ 3 Man : 440 yen |

- Out of time ATMs service that bank charges additional 100 ~ 200 Yen for each transaction. Office service: 8:45 -18:00.

- Smiles recommend using Chiba internet banking to transfer to the same account.

- Chiba ATMs are able to make a transaction in cash or other bank ATMs.

#7. Gunma

| Bank Charges | ATMs (Card/Book) | ATMs (Cash Transaction) | Tellers | Internet Banking |

|---|---|---|---|---|

| To Gunma same branch bank account | Free Of Charge | < 3 Man : 220 yen ≥ 3 Man : 440 yen |

< 3 Man : 330 yen ≥ 3 Man : 550 yen |

Free Of Charge |

| To Gunma bank account | < 3 Man : 110 yen ≥ 3 Man : 220 yen |

< 3 Man : 220 yen ≥ 3 Man : 440 yen |

< 3 Man : 330 yen ≥ 3 Man : 550 yen |

Free Of Charge |

| To other domestic bank | < 3 Man : 330 yen ≥ 3 Man : 550 yen |

< 3 Man : 550 yen ≥ 3 Man : 770 yen |

< 3 Man : 660 yen ≥ 3 Man : 880 yen |

< 3 Man : 220 yen ≥ 3 Man : 440 yen |

- Out of time ATMs service that bank charges additional 100 ~ 200 Yen for each transaction. Office service: 8:45 -18:00.

- Smiles recommend using Gunma internet banking to transfer to the same account.

- Gunma ATMs are able to make a transaction in cash or other bank ATMs.

#8. Fukuoka

| Bank charges | ATMs (card/book) | ATMs (Cash) | Tellers | Interner banking |

|---|---|---|---|---|

| To Fukuoka bank account | Free of charge | < 3 man : 220 yen ≥ 3 man : 440 yen |

< 3 man : 330 yen ≥ 3 man : 550 yen |

Free of charge |

| To other domestic bank | < 3 man : 220 yen ≥ 3 man : 440 yen |

< 3 man : 550 yen ≥ 3 man : 770 yen |

< 3 Man : 660 yen ≥ 3 Man : 880 yen |

< 3 man : 220 yen ≥ 3 man : 440 yen |

- Out of time ATMs service that bank charges additional 100 ~ 200 Yen for each transaction. Office service: 8:45 -18:00.

- Smiles recommend using Fukuoka internet banking to transfer to the same account.

- Fukuoka ATMs are able to make a transaction in cash or other bank ATMs.

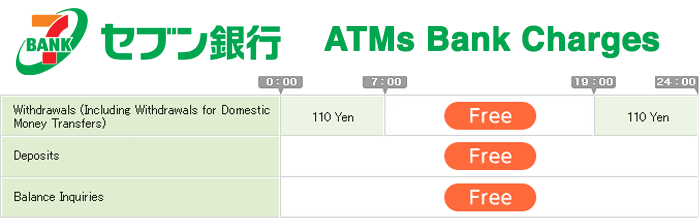

#9. Seven Bank

| Bank charges | ATMs | Tellers | Interner banking |

|---|---|---|---|

| To Seven bank account | Free of charge | < 3 man : 330 yen ≥ 3 man : 550 yen |

Free of charge |

| To other domestic bank | < 3 man : 220 yen ≥ 3 man : 440 yen |

< 3 man : 550 yen ≥ 3 man : 770 yen |

FOC 1 time a month From 2nd time : 220 yen |

- Please be noted that from 7AM – 7PM every single transaction at Seven Bank ATMs is free, such as withdrawals, deposits and balance inquiries. Out of this time service bank charges additional 100 ~ 200 yen.

- Smiles recommend using Seven internet banking to transfer to the same account.

- Seven ATMs are able to make a transaction in cash or other bank ATMs.

#10. Shinsei bank

| Bank Charges | ATMs | Tellers | Shinsei PowerDirect |

|---|---|---|---|

| To Shinsei bank account | Free of charge | < 3 man : 330 yen ≥ 3 man : 550 yen |

Free of charge |

| To domestic other bank | < 3 man : 220 yen ≥ 3 man : 440 yen |

< 3 man : 550 yen ≥ 3 man : 770 yen |

FOC 1 time a month From 2nd time : 220 yen |

- Please be noted that from 7AM – 7PM every single transaction at Seven Bank ATMs is free, such as withdrawals, deposits and balance inquiries. Out of this time service bank charges additional 100 ~ 200 yen.

- Smiles recommend using Shinsei PowerDirect internet banking to transfer to the same account.

- Shinsei ATMs are able to make a transaction in cash or other bank ATMs.

Please comment to let us know which bank charges you need to know. Have you guessed about what Smiles’s recommendation money transfer methods? 😉