Reasons Behind The Financial Struggles Of Some OFWs

Payments

Reasons Behind the Financial Struggles of Some OFWs

“What we reap, we sow” – according to the Bible. Ika nga, kung ano daw ang ating itanim, iyon din ang ating aanihin. In reality, life is what we make it. This is a natural law; which, can also be applied even to our financial conditions.

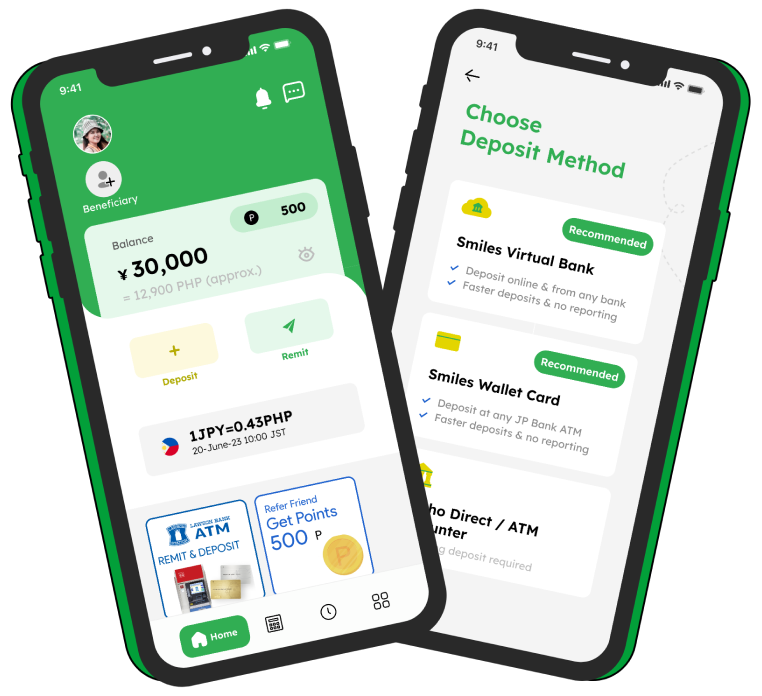

As an OFW, it is given that you have a better chance to achieve financial success because of the varied available opportunities within your grasp. Kaya lang, kailangan ng tamang diskarte sa iyong financial management. Of course, your family back home depends on you for financial support; and, it is a must to regularly send them money by hook or by crook. This is the reason for the existence of remittance companies like Western Union, Moneygram, Transferwise; and of course, Smiles, etc…; whereby, they cater services that offer convenient ways of sending money.

Relatedly, we all dream to achieve financial stability over a certain period of time. Therefore, it is best to share some realizations as to the wrong financial decisions commonly being made by OFWs.

1. OVER-SPENDING

Apparently, this is on top of the list of the wrong financial decisions commonly made by anyone experiencing financial struggles. We cannot correlate having a big income to being financially successful. Why is that so? The formula is simple. Income – Expense = Savings or Debt. Overspending is actually relatable to Debt. Opo – UTANG! Kasi po, continuous overspending will result in unmanageable debts. Then, unmanageable debts will lead to bankruptcy. Sad to say na ang common mistake ng mga OFWs kapag lumaki ang income, lumalaki din ang expenses. Mas mainam sana kung kaya nating baligtarin ang formula: Income – Savings = Expenses, para masiguro natin na hindi tayo lalabis sa gastos. Overspending must stop if you want to implement proper financial management. Budget your expenses within the limit of your income, net of savings. Have you heard of the 70-20-10 SALARY RULE? 70% for your living expenses (including luho, if any); 20%- should be your savings; and, 10% for the Lord – whichever way you want to help for charity purposes. It would take a lot of discipline; but, if you can manage to save the 20% ng walang dayaan at walang umitan pag nangangailangan- then, you will learn to live within your means.

2. OVER-HELPING

There is nothing wrong of being helpful. But we must first help ourselves. Sarili mo muna ang iyong tulungan para matiyak mo na lagi kang magkakaroon ng kakayahan na tumulong sa iba. We need to provide financial support, first & foremost, to our immediate family members. And the best financial support that you can provide is to assist them to generate their own income. Remember yung kasabihan ng matatanda- ‘huwag basta ibigay ang isda, turuan silang mangisda’.

Kailangan mo rin mag set ng deadline sa pag-provide for family members’ needs. At times, you can’t help it that many will ask for your help. And it may necessitate learning the art of saying NO to some requests for help; especially if they are already beyond your own capacity. You are not the answer to everyone’s needs. Over-commitment will drain your limited resources. It would be helpful if you make it a part of your financial plan to set aside a budget for helping others as part of your expenses or reserve a fund for charity purposes. Remember the SALARY RULE stated above. It may serve as your guide…

3. OVER INVESTING

There are so many choices of investments that may come to your attention. Some have the tendency to invest – left and right. They thought if they have many investments, they are securing their future. However, the problem is the quality of investment. Long-term investment should be funded by excess funds that may not be needed for a long period of time. Also, there is a need to evaluate the risks accompanying any investment. If it’s too good to be true, it is probably not true. Remember, ‘CASH is KING’ as they say! Better to have liquid assets at your disposal to meet your immediate needs. Do not put all your assets in investments. Sabi nga, ‘Don’t put all your eggs in one basket!’

We hope you learned something about the topic. Abangan ang next blog, we will share other common wrong financial decisions that OFWs commit; thereby, resulting to their financial struggles.