Tips To Make A Safe Bank Transfer (Furikomi) In Japan

Yucho

Tips on how to make a safe bank transfer and online payment is really important. You definitely need to know wherever you are, and here we would like to share on how to avoid scams before you arrive in Japan. It has become the concern of urban Japanese as well as Expats. Since September 2020, some of 380 bank accounts were stolen through an online payment application, which are expats’ accounts in Japan.

There are many methods to transfer money in Japan which are usually called Furikomi (振込). As you know, LINE Pay is a payment service in Japan which is very convenient and trusted to send money via app by QR Code or internet banking. Transfer money and online payment have been encouraged by the government to reduce the amount of cash in circulation, make transactions convenient, and easy to balance revenues and expenditures. But online payments always come with the risk of being stolen. So you need to learn about each service to ensure benefits and avoid unnecessary risks.

Bank account was stolen

In September 2020, Japan Post Bank as known as Yucho announced that it would suspend the sync of internet banking services with 8 out of 12 electronic payment services. Including LINE Pay, PayPay, PayPal, Kyash, PayB, Docomo Kouza, Rakuten Pay, and Visa Prepaid MIJICA cards issued by Yucho. With the total amount of 60 million yen stolen from Yucho, they announced they were investigating transactions from 380 Yucho accounts.

In 2016, users of credit cards and ATMs in Japan encountered a big issue; within 2 hours, over 1.4 billion yen disappeared from about 1,400 ATMs. Japan International Police investigated that more than 1600 credit cards were counterfeited by gangs in South Africa.

According to some information, this Yucho card theft has affected some expat communities in Japan. Currently, Japan Post Bank Yucho, together with its subsidiaries Docomo and LINE Pay have started to investigate the case.

What you should do to protect your bank account?

There are several tips recommended to protect your bank account from being stolen or hacked. It depends on what kind of bank account, electric payment, application or ATM card you can apply to avoid being stolen.

- NOT – Make an online payment through unreservedly e-commerce platforms. There can be online shops, games or applications that you feel uncertain about whatever their attractive promotion is.

- Signal of a safe online shopping website is SSL certified which shows on the browser.

- Most of the cases are stolen via e-wallet due to leaking bank account information such as exposing encrypted payments (QR Code), or entering OTP code to confirm payment encryption from strange phone numbers, messages.

- Avoid making online payment using wifi network in public places (coffee shop, restaurant, station)

- Only withdraw money by a trusted ATM machine, you should stop the transaction and call the service center to block the card and make a report if there is any suspicious situation.

Please remember to verify and make 2-step verification of your bank account as well as ATM / credit card, e-wallet application since you registered or activated them.

Verify Yucho card

Yucho cards are quite popular in expat communities in Japan, so it is really necessary to learn how to protect a Yucho bank account, as well as to secure a Yucho card. Furthermore, verification also helps you in case you need banking services from the bank and avoid unfortunate cases.

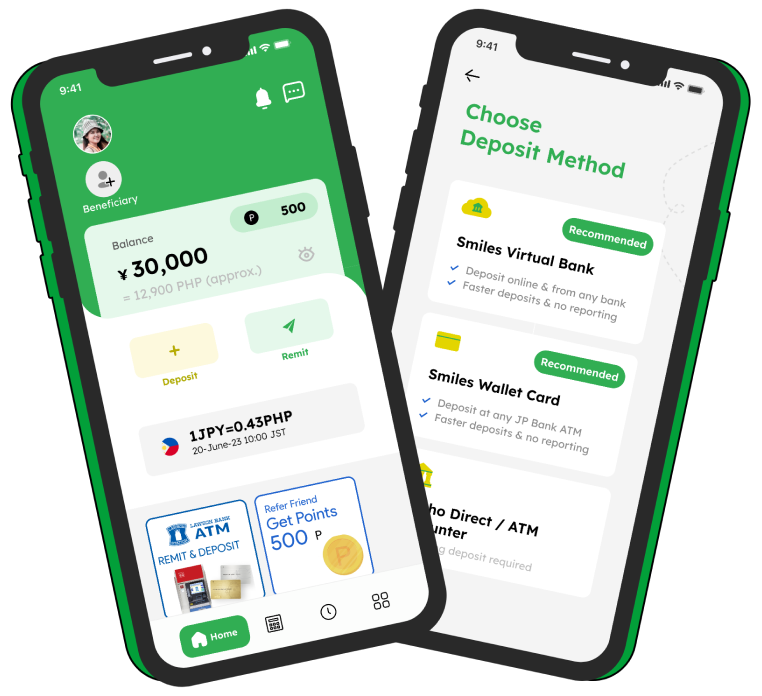

There is a reason to block a bank account or card because of non-verified or incorrect information while you verify your account such as the wrong address. Occasionally, some customers asked SMILES about why their Yucho card did not work or could not do a transaction. We found these cases and found out that Yucho blocked some of their customers’ cards, so we shared a little information on how to verify Yucho accounts.