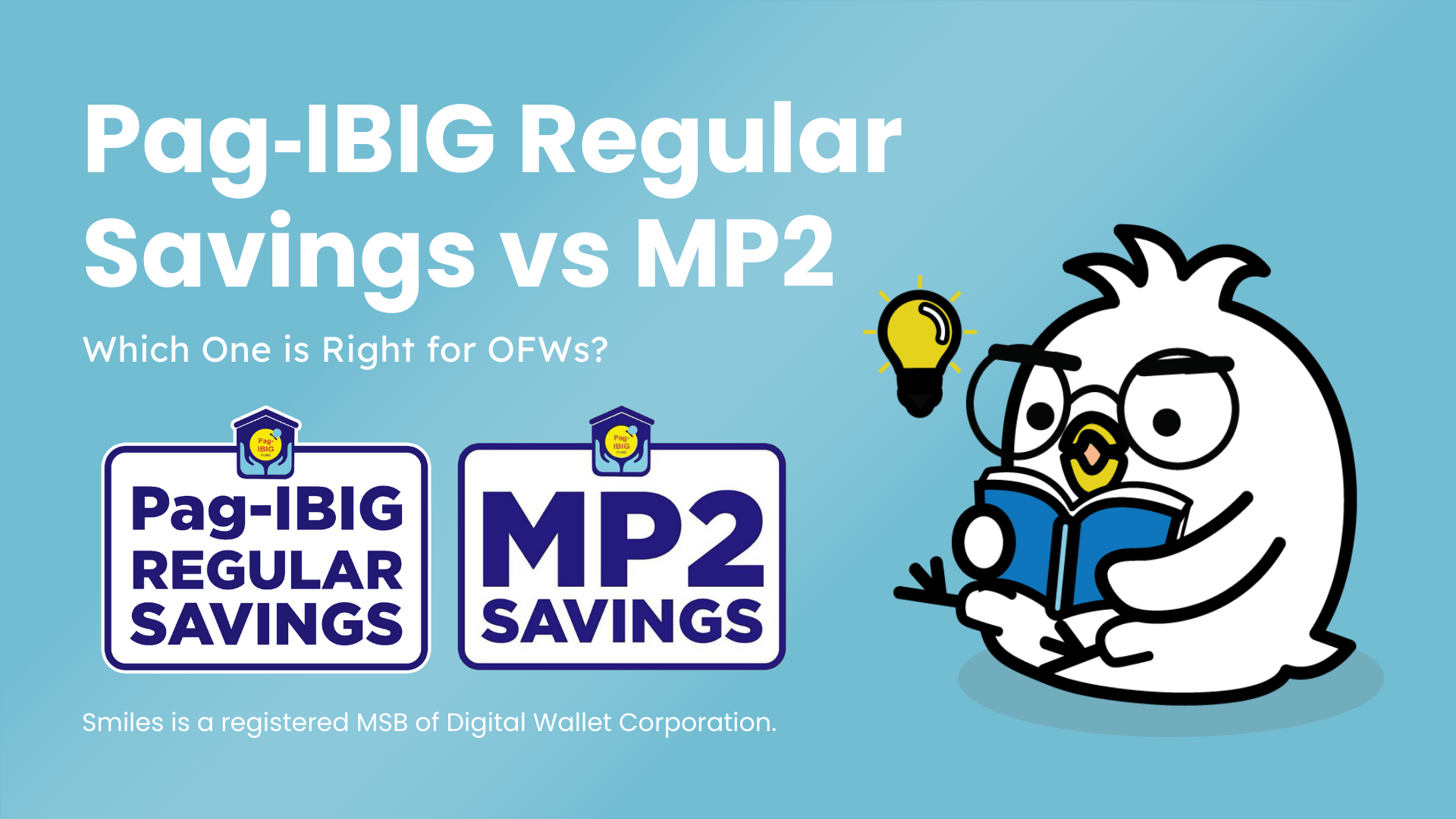

Pag‑IBIG Regular Savings vs MP2: Which One is Right for OFWs?

Table of contents

For Overseas Filipino Workers (OFWs) in Canada, saving and investing in the Philippines can feel challenging, but Pag‑IBIG Fund programs offer reliable ways to grow your money. Two of the most popular options are Pag‑IBIG Regular Savings vs MP2. Understanding the differences and benefits of each can you to make smarter financial decisions.

What is Pag‑IBIG Regular Savings?

Pag‑IBIG Regular Savings is the mandatory membership savings account required for all Pag‑IBIG members. For OFWs, maintaining this savings ensures continued membership and access to Pag‑IBIG benefits.

Benefits for OFWs:

- Access to Housing and Multi-Purpose Loans – Even while working abroad, your contributions help you qualify for Pag‑IBIG housing programs and multi-purpose loans for emergencies or personal projects.

- Long-term Savings – Contributions grow over time, providing a reliable fund for retirement or other future needs.

- Dividends – Your savings earn annual dividends, which amounted to around 6.6% in 2024.

Regular Savings acts as a foundation for your Pag‑IBIG membership, ensuring eligibility for essential benefits while abroad.

What is Pag‑IBIG MP2 Savings?

Pag‑IBIG MP2 Savings is a voluntary program designed for members who want higher returns and flexible contributions. Unlike Regular Savings, MP2 focuses on growth and medium-term financial goals.

Benefits for OFWs:

- Higher Dividends – MP2 offers higher annual dividends (around 7.1% in 2024), helping your savings grow faster.

- Flexible Contributions – OFWs can contribute as little as ₱500 per remittance and adjust contributions according to their income.

- Tax-Free Earnings – Dividends are 100% tax-free.

- Medium-Term Planning – MP2’s 5-year maturity allows strategic planning for investments, business, or property in the Philippines.

- Multiple Accounts Allowed – OFWs can open more than one MP2 account to diversify savings goals.

MP2 complements Regular Savings, acting as a growth-focused strategy for OFWs who want to maximize their money.

Pag‑IBIG Regular Savings vs MP2

Understanding the main differences can help OFWs decide how to use these programs effectively:

| Feature | Regular Savings | MP2 Savings |

|---|---|---|

| Type | Mandatory | Voluntary |

| Dividend Rate | ~6.6% | ~7.1% |

| Term | No fixed maturity | 5-year fixed maturity |

| Flexibility | Limited | High |

| Access | Upon membership maturity | After 5 years (with special early withdrawal cases) |

| Purpose | Basic membership benefits | Medium-term savings and growth |

By comparing Pag‑IBIG Regular Savings vs MP2, OFWs in Canada can see that Regular Savings secures membership and basic benefits, while MP2 offers flexibility and higher returns for strategic financial goals.

Pay Pag‑IBIG Contributions Easily with Smiles Mobile Remittance

Managing savings from Canada has never been easier. Smiles Mobile Remittance lets OFWs pay Pag‑IBIG Regular Savings, MP2 contributions, and other bills directly from Canada. You can save time, avoid banking hassles, and ensure your contributions reach the Philippines safely and on time.

Whether you’re focused on security, growth, or both, understanding Pag‑IBIG Regular Savings vs MP2 helps OFWs make informed decisions. Regular Savings builds your membership foundation, and MP2 accelerates growth — together, they provide a solid path to financial stability.