Pay SSS Philippines and Pag-IBIG from Canada

Fintech

A number of benefits and advantages are entitled to OFWs (Overseas Filipino Workers) once they become active members of the Social Security System (SSS) and Pag-IBIG. For instance, if one is a member of SSS, one can avail of retirement, funeral and death benefits. One can also apply for various loans for housing, business and education.

On the other hand, if one is a member of Pag-IBIG, they can apply for the Regular Savings Program or the MP2 (Modified Pag-IBIG 2) Savings, which has annual dividends that are tax-free. One can also apply for housing programs and loans with repayment terms of up to 30 years.

Read more: Invest in Pag-IBIG and SSS

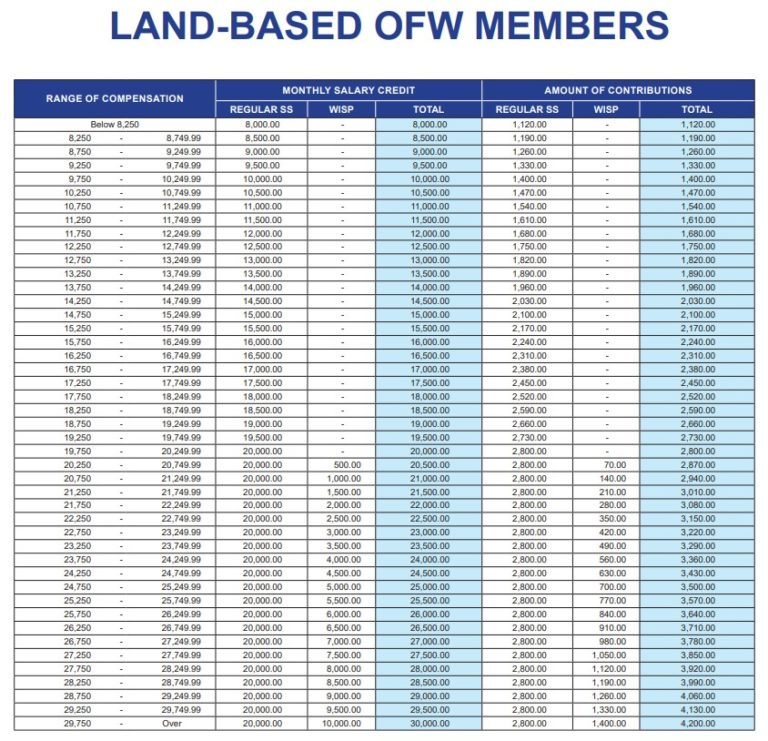

SSS Philippines – monthly contributions for OFWs

As of January 2023, SSS has updated the contribution rate to 14% of the monthly salary of its members. Based on the table below, if an OFW earns a monthly salary credit of 20,000 PHP, then they are required to contribute a monthly amount of 2,800 PHP. If they earn a monthly salary credit of 30,000 PHP, then they are required to contribute 4,200 PHP per month.

Here is the SSS contribution table 2023 for your reference.

Source: SSS Contribution table 2023

OFWs are requested to check the updates from the SSS Website as the rate of monthly contributions is expected to change on a yearly basis.

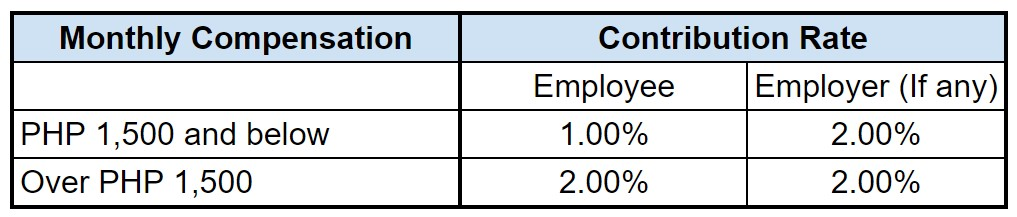

Pag-IBIG monthly contributions for OFWs

For OFWs who are members of Pag-IBIG, they will only be required to contribute 2% of their monthly wage. In this case, if one earns 30,000 PHP, one will be required to contribute an amount of 600 PHP. In relation to this, it is noted that the initial monthly contribution for Pag-IBIG is only 100 PHP.

Source: Pag-IBIG Contribution Rate

Benefits and advantages for SSS and Pag-IBIG members

a. SSS Benefits

Being an active member of SSS entitles one to receive various benefits including the following:

Disability – A member, who becomes permanently disabled – partially or totally – can choose to receive a cash benefit, either monthly or as a lump sum.

Retirement – A member, who can no longer work because of old age, can choose to receive a cash benefit, either monthly or as a lump sum.

Death – The beneficiaries of a deceased member are eligible to receive cash benefits, either as a monthly pension or a lump sum.

Unemployment – OFWs who are involuntarily laid off by a company, due to retrenchment, closure of business, etc., are entitled to receive the unemployment benefit.

For more information on the benefits available for SSS members, click here.

b. Pag-IBIG Benefits

An active Pag-IBIG member is entitled to avail the following benefits:

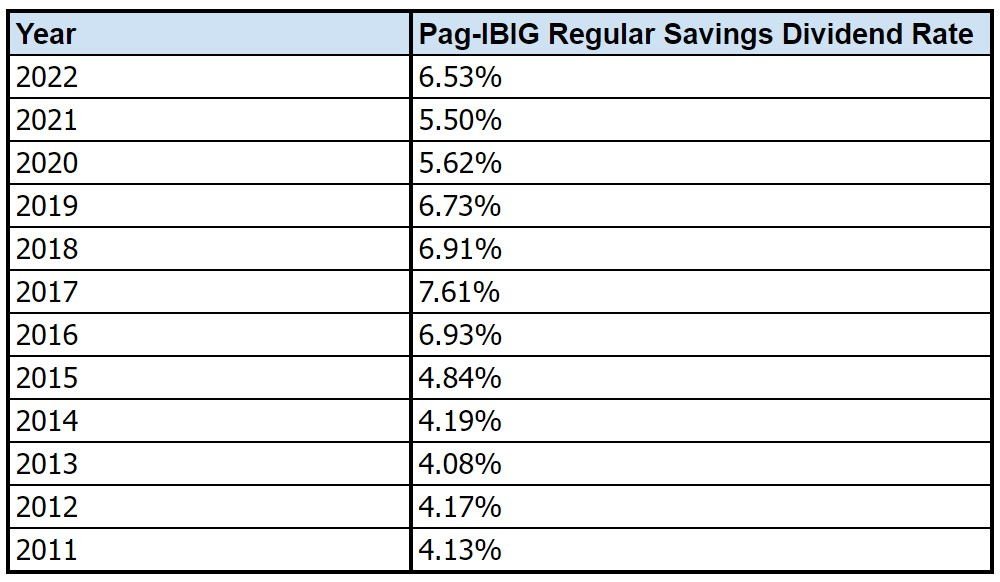

Savings – The savings program of Pag-IBIG allows members to earn high annual dividends. Members can eventually use this benefit for their retirement and other essential needs.

This table shows the Pag-IBIG Regular Savings Dividend Rates since 2011.

Source: Pag-IBIG’s Dividend Rate

Short-Term Loan – A member can apply for a short-term loan to help address their financial needs.

Housing Loan – A member, who has been actively contributing to Pag-IBIG, is eligible to apply for the housing loan program. This loan program provides low monthly amortization fees, which is suitable for many OFWs, and the repayment term is up to 30 years.

For more information on the benefits available for Pag-IBIG members, click here.

Overall, OFWs are encouraged to become members of SSS and Pag-IBIG so they can avail themselves of their benefits and advantages. They can utilize them for their retirement and other essential needs. Moreover, OFWs and other members are advised that the benefits that a member may receive either from SSS or Pag-IBIG will depend on the number of contributions that one has provided over the course of their membership.

Smiles Mobile Remittance – Rate today from Canadian dollar to Philippine peso

Loading..

Related articles:

How to use Smiles Remittance Canada to send money to the Philippines

Smiles Mobile Remittance Enables Affordable Money Transfers for Vietnamese in Canada