Wise Money Transfer Exchange Rate and Fees

Untagged

Overview

Money Without Borders, this is what Wise stands for. Wise was launched in 2011 with a vision to make international money transfers cheap, fair, and simple. Today their multi-currency account helps millions of people and businesses manage their money across the world. The wise mission is to build the best way to move and manage the world’s money, just like sending an e-mail, to make it faster, more convenient, transparent, and eventually free.

One advantage Wise has is the Wise Business, tailored made for international businesses that save money wherever they want to use it, including salaries of employees based in other countries. You can send, spend, and withdraw in 40 currencies, all in one account. Wise Business is now open in 13 countries, making it easier to allocate roles and approval rules. They provide annual fee statements for transparency and tailored scam prevention tools. With Wise Business you can: Send Money, Receive and Add money, Use a Wise debit card, and hold money in your account.

Fees and Processing Time

Wise online money transfer has over 16 million customers. They offer fair prices with no hidden fees, see their fees upfront, and only pay for what you use. They charge a direct debit fee plus their transfer fee. Their App also offers rate comparison from other Remittance companies, like Remitly, XE, WorldRemit, PayPal, and OFX, and with Banks like RBC and TD. Wise guaranteed their offered rate for 76 hours, and money should arrive in 25 minutes.

Wise Currency Converter

Everyday Great Rate with Smiles

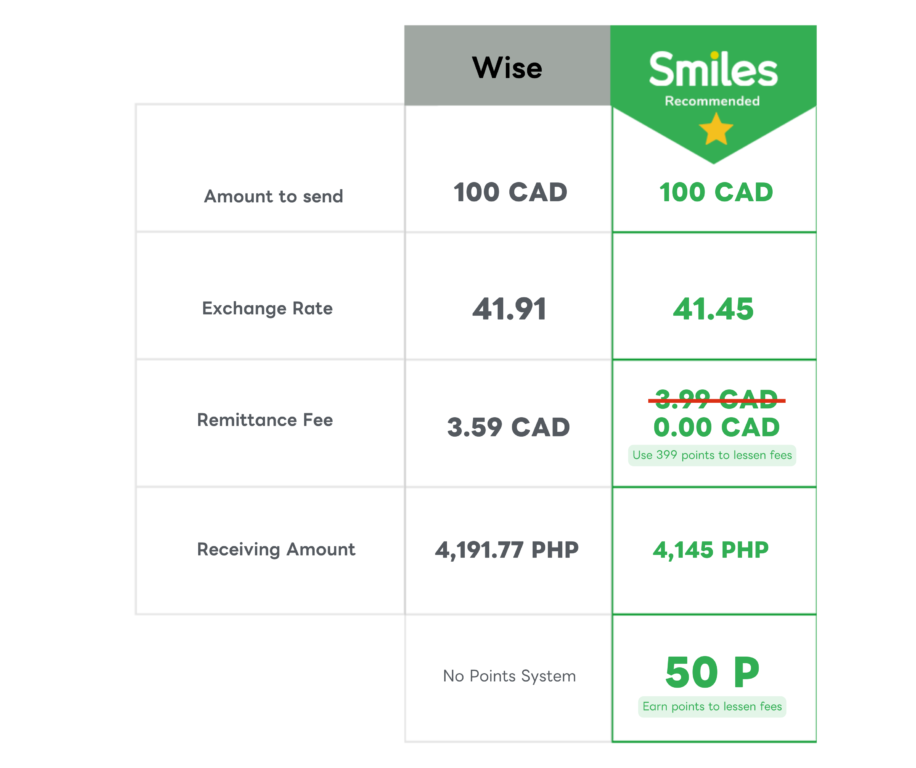

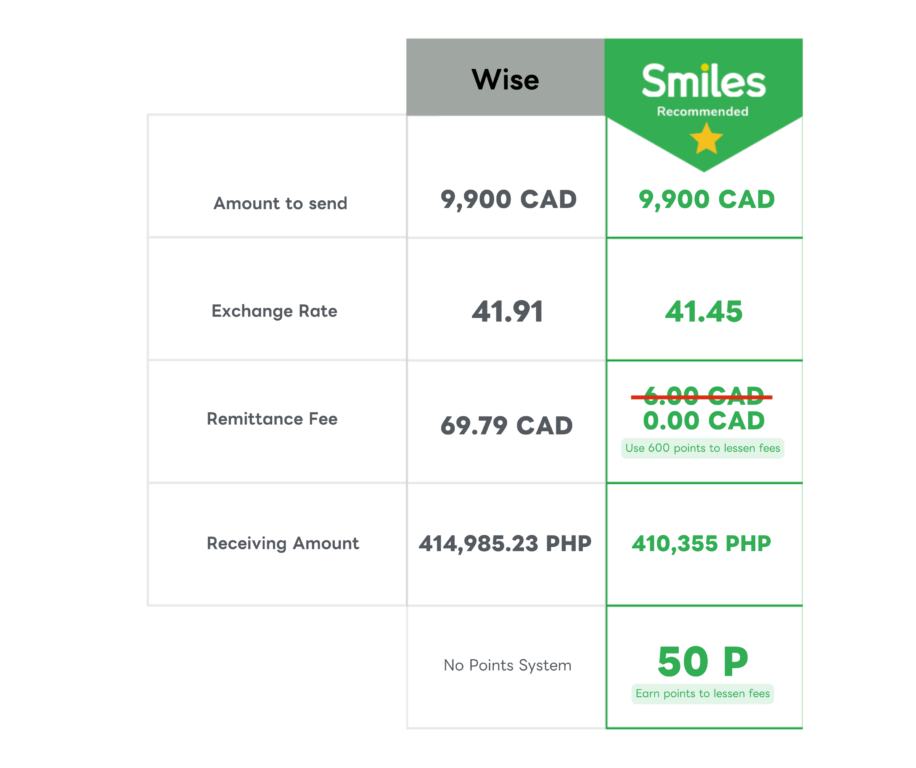

Wise in comparison with Smiles

As of August 7th, the exchange rate for Wise is 41.91, which is slightly higher than Smiles Mobile Remittance’s rate of 41.45. However, it’s essential to consider the overall cost of remittance, including fees and charges, to make an informed decision.

Wise applies a variable fee for sending money to the Philippines, dependent on the amount being sent. The higher the sum, the higher the fees.

On the other hand, Smiles Mobile Remittance offers a more affordable fee structure. For remittances up to $100, the Bank Credit fee starts at just $3.99, making it an attractive option for smaller transactions. For remittances over $100 up to $9,999.00, Smiles charges a flat rate of $6.00, which can be advantageous for medium-sized transfers. Moreover, if you prefer a Cash Pickup option, Smiles maintains a flat rate of only $8.00 for remittances up to $9,999.00.

Smiles Mobile Remittance – Today’s rate

Loading..

Related Article:

The Secret of Everyday Great Rates by Smiles Mobile Remittance

How to use Smiles Remittance Canada to send money to the Philippine

3 Reasons why Canadian dollar to Philippine peso exchange rate is going up/down